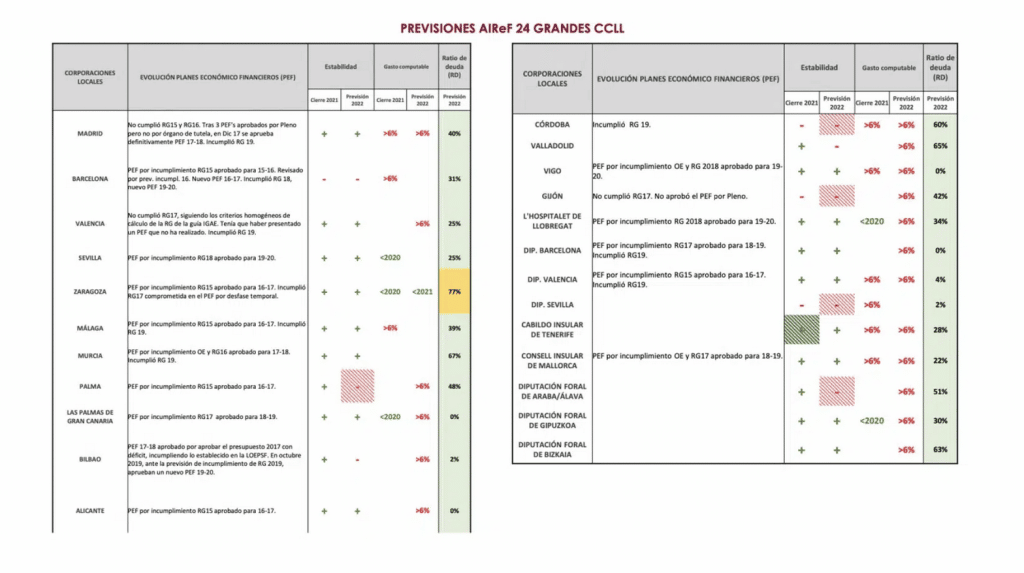

It also analysed the performance of the 24 large LGs. AIReF estimates that the growth of the group’s eligible expenditure will increase by more than 10%, thus intensifying the trend of expanding expenditure that started before the pandemic. This would place the growth of eligible expenditure, from 2018 to 2022, at almost 35%. This incremental trend in spending, if maintained, particularly in the case of current expenditure, could have an impact on the future sustainability of their public accounts.

Of the 24 large LGs analysed by AIReF, 13 are expected to record a deficit in 2022, of which six estimated a surplus in April of this year. The city councils of Barcelona, Bilbao, Córdoba, Gijón, L’Hospitalet, Las Palmas de Gran Canaria, Palma, Valladolid and Vigo, the Provincial Council of Seville and the Island Council of Tenerife and the Provincial Councils of Bizkaia and Araba/Álava expect to record deficits in 2022. With respect to the previous report, the Provincial Council of Seville and the Island Council of Tenerife and the city councils of Córdoba, Gijón, Vigo and L’Hospitalet have gone from forecasting a surplus to forecasting a deficit. The deficit forecast by the City Council of Palma is particularly significant, amounting to over 10% of its non-financial revenue.

For its part, AIReF estimates a deficit for eight large Local Governments, while this number stood at three in the April report. AIReF’s estimates show a deficit for the city councils of Barcelona, Bilbao, Córdoba, Gijón, Palma and Valladolid, the Provincial Council of Seville and the Provincial Council of Araba/Álava, mainly as a result of the high growth in spending expected this year.

In the Report, AIReF continues to monitor the 24 large LGs in which it identified, at the start of the cycle, significant medium-term sustainability problems. All the LGs with sustainability risks maintain their risk rating, although AIReF notes improvements in the medium-term situation of the city councils of Alcorcón, Algeciras, Aranjuez, Los Barrios, Gandía and San Andrés del Rabanedo, a situation that will have to be verified once this year is settled.

The councils of Lepe and Arroyomolinos leave the risk analysis and the City Council of San Fernando de Henares is classified for the first time in a very high-risk situation, but with significant uncertainties given the deficiencies of the information submitted.

Due to its impact on the ability to revert to a sustainable situation, AIReF is particularly concerned about the situation of the city councils of Jaen and Parla, with a critical risk rating, which implies that in a no-policy-change scenario for revenue and expenditure, a return to a sustainable situation is not deemed to be feasible as they continue to generate negative balances that further harm their position. Similarly, due to its negative impact on said ability to revert to sustainability, it also deems as concerning the increase in eligible expenditure forecast for 2022 in the city councils of Almonte and Parla, of 50% and 40%, respectively, as well as those of Aranjuez, Los Barrios and San Fernando de Henares, of around 20%.

For the first time, AIReF analyses the representativeness in the local sub-sector of the different types and groups of governments that make it up, with respect to the main fiscal and financial indicators, such as net lending/borrowing, outstanding debt and liquid assets.