- AIReF points out the risks for sustainability, which include a scenario of stagflation in the European Union, an upturn in interest rates, the increase in contingent liabilities through the Guarantee Lines and the expected increase in healthcare spending and pension spending as a result of the ageing population

- In the Debt Monitor, AIReF sets out the latest outlook for global economic recovery, less vigorous than initially expected and worsened by the outbreak of the war in Ukraine

- It notes that the figure for year-end 2021 debt at 118.7% of GDP is an improvement compared with all the forecasts, even though it implies a rise of 23.1 points on the pre-pandemic level

- It points out that the Central Government and the Social Security Funds have borne 90% of the increase in debt over the last two years by financing most of the expenditure associated with the pandemic

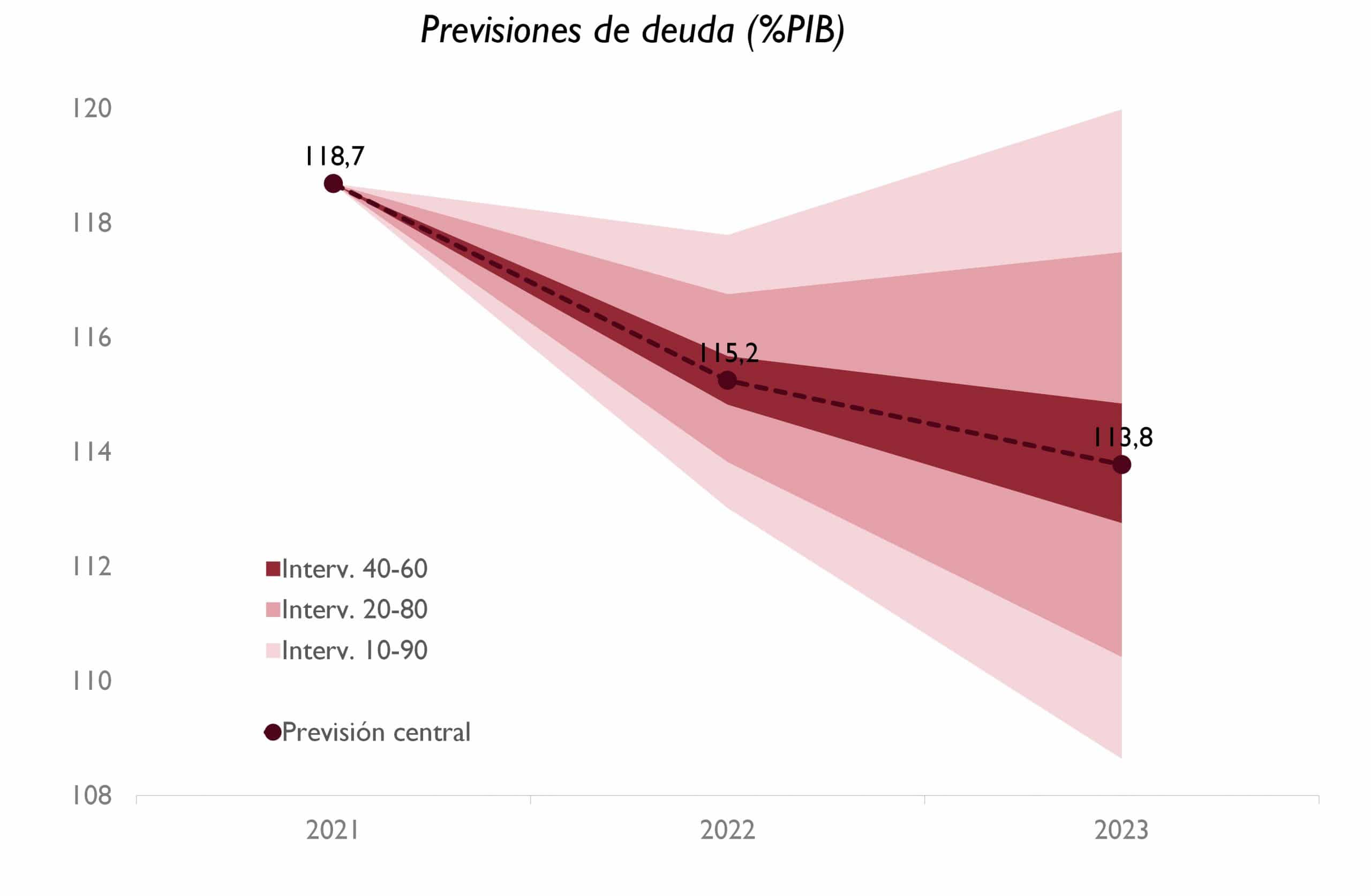

- AIReF’s forecasts, in line with those of the Government and other international organisations, project a reduction of almost 5 points in the debt ratio by 2023, placing it at 113.8% of GDP The reduction will be mainly supported by economic growt

- AIReF’s models project that the financial burden and average debt rates will continue to fall in the short term

The Independent Authority for Fiscal Responsibility (AIReF) has updated the Public Debt Monitor after learning that the debt ratio closed 2021 at 118.7% of GDP, a reduction of 1.3 points for the year as a whole. The macro-fiscal forecasts published by AIReF in January project a decrease in the debt-to-GDP ratio of 4.9 points over the level recorded in 2021, bringing it to 113.8% in 2023.

In the Debt Monitor, AIReF states that 2022 has started with a less vigorous outlook for global economic recovery than initially expected. Moreover, this scenario has worsened as a result of the outbreak of war in Ukraine. Inflation expectations, for their part, remain anchored, but the persistence of price tensions, intensified following the start of the armed conflict, might trigger upward spirals and second-round effects, which would complicate the design of monetary policy in an environment of worsening global growth forecasts.

In this context, the Spanish debt-to-GDP ratio stood at 118.7% at the end of 2021, a reduction of 1.3 points over the year. This year-end 2021 level is an improvement compared with all the forecasts, both from national and international organisations, although it is 23.1 points higher than the pre-pandemic level. By tier of government, the Central Government and the Social Security Funds have borne the bulk of the increase in debt in the last two years (20.9 points) by financing most of the expenditure associated with the pandemic.

In the short term, the macro-fiscal forecasts published by AIReF in January project a reduction in the debt-to-GDP ratio of 4.9 points on the level recorded in 2021, placing it at 113.8% in 2023. This forecast is in line with the 115.1% forecast by the Government in the draft Budgetary Plan for 2022. The projections by international organisations show a similar profile of reduction in the debt ratio for the next two years, although from a starting point slightly higher than the one eventually recorded at year-end 2021. According to AIReF, the reduction in the ratio will mainly be supported by economic growth, as the persistent deficit will continue to contribute substantially to the increase in debt despite the reduction in the financial burden.

Cost of the debt

Despite higher borrowing needs, AIReF notes that the cost of the debt has continued to fall, recording a new all-time low and placing the average cost of the Treasury’s issues for the year as a whole in negative territory for the first time. The low issuance rates have made it possible to reduce and stabilise the financial burden despite a marked increase in debt. According to AIReF, the current low interest rate environment continues to favour the dynamics of the debt ratio in the long term, helping to generate a positive “snowball” effect over the coming years. In the short term, AIReF’s models project that this trend of a slight reduction in the financial burden and average debt rates will continue.

In the Debt Monitor, AIReF notes that the latest meetings of the Governing Council of the European Central Bank (ECB) point towards a certain withdrawal of stimulus measures through the termination of purchasing programmes such as the PEPP. However, the door is left open to calibrate this type of non-conventional tool according to the evolution of the economic situation. Nevertheless, the new crisis scenario that has emerged following the invasion of Ukraine may alter the pace of the process of normalisation of monetary conditions expected over 2022, following the sharp increase in inflation worldwide. These increases have exceeded all forecasts month after month, thereby casting doubt on the temporary nature of inflation.

Yield

AIReF notes that financial markets have started the year by adjusting to this new scenario of high inflation and foreseeable rises in interest rates, favouring a correction in equities and an increase in yields in all sovereign debt tranches. However, with the start of the invasion of Ukraine, financial markets have begun to reassess the outlook for monetary policy, with sharp falls recorded in the yields on sovereign debt, driven by its nature as a safe-haven asset.

The yield on the Spanish 10-year bond stood at around 1% at the end of the Debt Monitor, an increase of almost 60 basis points in the last three months. The spread between the Spanish and Italian 10-year bonds and the German bond (risk premium) has widened by 30 and 40 points compared with last year’s average, to 100 and 155 basis points, respectively. The US 10-year bond, which has even exceeded 2%, stands at around 1.85%, while the German bond has returned to negative territory after a month of trading at positive figures. Following a year – 2021 – with interest rates close to historical lows, the sovereign debt yield curve stands close to two-year highs, in the vicinity of the stress levels recorded at the start of the pandemic. However, from a historical perspective, interest rates can be considered low.

For 2022, the Public Treasury proposes a borrowing schedule similar to that of 2021, maintaining the goal of net issues at the 75 billion recorded at the end of 2021. In 2022, the Public Treasury will once again have the Next Generation EU funds as an additional source of financing. Looking ahead to the coming years, a stabilisation of the gross financing needs in monetary terms is expected, which will gradually decrease in relation to GDP. According to AIReF, State debt has a low refinancing risk with a well-distributed maturity profile over the coming years, with moderate maturities in the short term and a granular distribution in the medium and long term.

On the distribution of debt, AIReF notes that over recent years the ECB has made net purchases of Spanish debt in excess of 100% of net borrowing, which has helped to preserve very favourable financing conditions for public debt. The Bank of Spain has become one of the leading holders of Spanish government debt, increasing its share of total debt by 25 points in the last five years to around 35%. In the long term, AIReF considers that the reduction of sovereign debt on the ECB’s balance sheet may pose a major challenge.

Risks for sustainability

Regarding the risks to sustainability, AIReF notes that the invasion of Ukraine raises the risk of stagflation in the European Union, where high inflation could become more persistent, triggering upward spirals and second-round effects that would complicate the process of normalising monetary policy. A rise in sovereign debt interest rates would have a limited impact on the interest expenditure in the short term due to the high average maturity of the portfolio. In the medium and long term, a low interest rate environment will be essential to alleviate the fiscal effort required to keep public debt on a downward path.

In addition, the increase in contingent liabilities through the Guarantee Lines poses a risk in the short and medium term, although its impact is limited. Finally, the expected increase in healthcare spending and pension spending as a result of the ageing population is one of the main risks for the sustainability of public finances in the medium and long term.