The Independent Authority for Fiscal Responsibility (AIReF) published the Report on the Initial Budgets of the General Government (GG) for 2024 and the individual reports of the Autonomous Regions (AR) on its website today. AIReF estimates that the sub-sector as a whole will close 2024 with a deficit of 0.1% of GDP and sees a risk of non-compliance with the expenditure rule, which applies this year following the reactivation of the fiscal rules.

Specifically, AIReF estimates that in 2024 the sub-sector could record a deficit of 0.1 points of GDP, in line with the Budgetary Plan forecasts and higher than the balance contained in the Stability Programme. While this figure is 0.3 points worse than the forecasts in the previous report, it is an improvement on year-end 2023, due to the extraordinary revenue from the settlement of the regional financing system. In addition, instalment payments also grow by 8.3%.

AIReF’s forecasts for 2024 place the growth in eligible expenditure for the purposes of the expenditure rule at 5.7%, 0.4 points of GDP above the level set by the reference rate of 2.6%, which could jeopardise compliance with the country-specific recommendation issued by the European Council for 2024. Compliance with the expenditure rule in 2024 would enable the sub-sector to record a surplus of 0.3 points of GDP. At an individual level, all the ARs are at risk of non-compliance with the expenditure rule.

AIReF’s forecasts also worsen the balance of the ARs in the period 2024-2028 with regard to the October report, due to the incorporation of revenue under the regional financing system for 2024 that was notified to the ARs at the close of 2023, the updated information on European funds and the approval of new expenditure measures at the regional level. In contrast, albeit with less impact, the new fiscal measures adopted by some Autonomous Regions and the review of the macroeconomic scenario have slightly improved the outlook for the sub-sector.

Specifically, after the extraordinary settlement received in 2024, as from 2025, the balance of the ARs will deteriorate to stabilise at a deficit of around 0.2% of GDP. Furthermore, between 2024 and 2028, primary expenditure net of revenue measures will grow by an average of 3.7% per annum.

Individual analysis

At the individual level, the year-end forecasts for 2024 for almost all the ARs are worse than in the previous report. Practically all the individual changes fundamentally stem from the year-end 2023 data, the information on the execution of European funds and the incorporation of the revenue from the financing system for 2024 that was notified to the ARs under the ordinary regime. As a result, the forecasts worsen in all the ARs except Rioja.

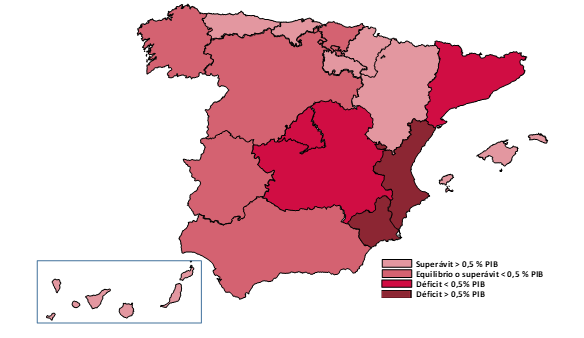

Nevertheless, AIReF estimates that most of the ARs will close 2024 with a surplus or balance close to equilibrium. Although the individual estimates have worsened compared with those made in October, AIReF forecasts that only Murcia and Valencia will close 2024 with a deficit of more than 1%, while it expects moderate deficits in Catalonia and Castile-La Mancha and a balance close to equilibrium in Extremadura, Madrid and Andalusia. The rest of the ARs will close the year with a surplus.

AIReF also estimates that eligible expenditure will grow in all the ARs by more than the 2.6% reference rate set for 2024. The changes calculated range across the Autonomous Regions by between 4% and 10%, conditioned by the expected growth in expenditure, the change in expenditure financed with European funds and the effect of the tax reduction measures adopted in each of the ARs.

AIReF recommends that all Autonomous Regions should monitor the execution of their budgets by adopting the measures they deem appropriate to correct the growth in eligible expenditure for the purposes of the expenditure rule and thus avoid the structural deterioration of their accounts in the medium and long term.

The individual reports published today by AIReF contain the breakdown of the updated forecasts for 2024, including the revision of the medium-term outlook for each of the ARs.