The Independent Authority for Fiscal Responsibility (AIReF) published the Report on the Initial Budgets of the General Government (GG) for 2024 today, which is accompanied by the individual reports on the Autonomous Regions (ARs) and the supplementary individual evaluation report on the Local Governments (LGs). In this supplementary report, AIReF performs an individual and group analysis of the 25 large Local Governments that, due to the size of their budgets, powers, organisational structures and population affected, have a decisive influence on the results of the sub-sector. AIReF estimates a surplus of 0.1% of GDP in 2024 for the sub-sector as a whole, 0.1 points lower than in the previous report, and it foresees a risk of non-compliance with the expenditure rule in 10 of these LGs.

In the medium term, AIReF estimates that the balance of the LGs will stabilise at close to equilibrium and that expenditure net of revenue measures will grow between 2024 and 2028 at an average rate of 3.7% per annum.

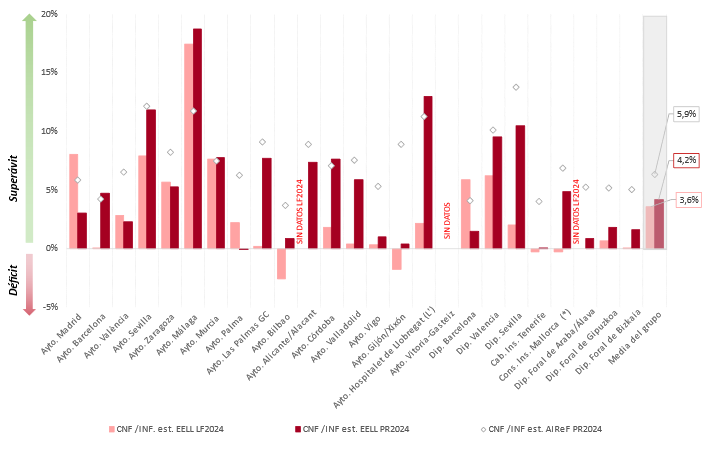

In the group of the 25 large Local Governments, AIReF estimates a revenue surplus of 6% in 2024, improving on the content of the previous report, due to a better year-end 2023 position for this group. These forecasts would amount to an overall balance close to equilibrium if the effect of the extraordinary revenue to be received in 2024 from the financing system is removed, both due to the higher settlement from 2022 compared with an average year and due to the compensation to be received this year from the negative settlement in 2020.

At the group level, AIReF estimates that the large Local Governments will increase their eligible expenditure by 2.3% in 2024, below the approved rate for the year of 2.6%, albeit with very uneven individual rates, negative in some cases and with growth of over 16% in others. These projected growth rates are based on the high levels resulting from the increase in eligible expenditure in the period of suspension of the fiscal rules, in which the average annual growth of eligible expenditure of the group of large LGs stood at 9% due to the possibility of increasing their expenditure with accumulated savings without incurring a breach. This expenditure financed with surpluses carried over amounted to more than €4.2 billion in the period 2020-2023.

At the individual level, AIReF expects the large Local Governments to obtain a surplus, although if the extraordinary impact of the revenue from the financing system is removed, five of them would incur a deficit. These large LGs are the City Councils of Madrid, Barcelona and Valencia and the Provincial Councils of Barcelona and Valencia. In terms of the expenditure rule, the growth in eligible expenditure forecast by AIReF for 2024 in 10 of the entities analysed is more than 5% and there is therefore a risk of non-compliance with the reference rate. These entities are the City Councils of Madrid, Valencia, Palma, Las Palmas de Gran Canaria, Alicante/Alacant and Gijón/Xixón; the Provincial Councils of Barcelona and Seville, the Island Council of Tenerife and the Chartered Council of Araba/Álava.

As a new feature, AIReF includes in this report the evaluation of the net asset/liability position of the large Local Governments determined according to the financial assets they hold and their liabilities. These LGs have no debt problems as their debt-to-income ratio is below the 75% limit. They also have significant accumulated savings that could not be applied to expenditure in times of compliance with the rules but could be used during the period of suspension. The analysis of their net position shows how this has improved or worsened after the activation of the escape clause, as they have been able to mobilise their financial assets. Only the City Councils of Las Palmas de Gran Canaria, Bilbao, Alicante/Alacant, Vigo and Gijón/Xixón, the Provincial Councils of Barcelona, Valencia and Seville, the Island Council of Tenerife and the City Council of Majorca expect to end 2024 with a net asset position, as they have a level of savings resulting from the last cash surplus that exceeds the debt expected at the end of this year.

Recommendations

Given the high risk of non-compliance with the expenditure rule of 10 of the large Local Governments analysed, AIReF recommends the City Councils of Madrid, Valencia, Palma, Las Palmas de Gran Canaria, Alicante/Alacant, Gijón/Xixón, the Provincial Councils of Barcelona and Seville, the Island Council of Tenerife and the Chartered Council of Araba/Álava to monitor their budget execution and adopt the measures they deem appropriate to correct the growth in eligible expenditure for the purposes of the expenditure rule and thus avoid the structural deterioration of their accounts in the medium and long term.

AIReF explains that, to the extent that these increases in expenditure are consolidated for future periods, their materialisation would entail a deterioration in the sustainability of the finances of the entities concerned and would also have a negative impact on the whole LG sub-sector and, to a lesser extent, on compliance with the specific recommendation for Spain to limit the growth of primary expenditure net of revenue measures.