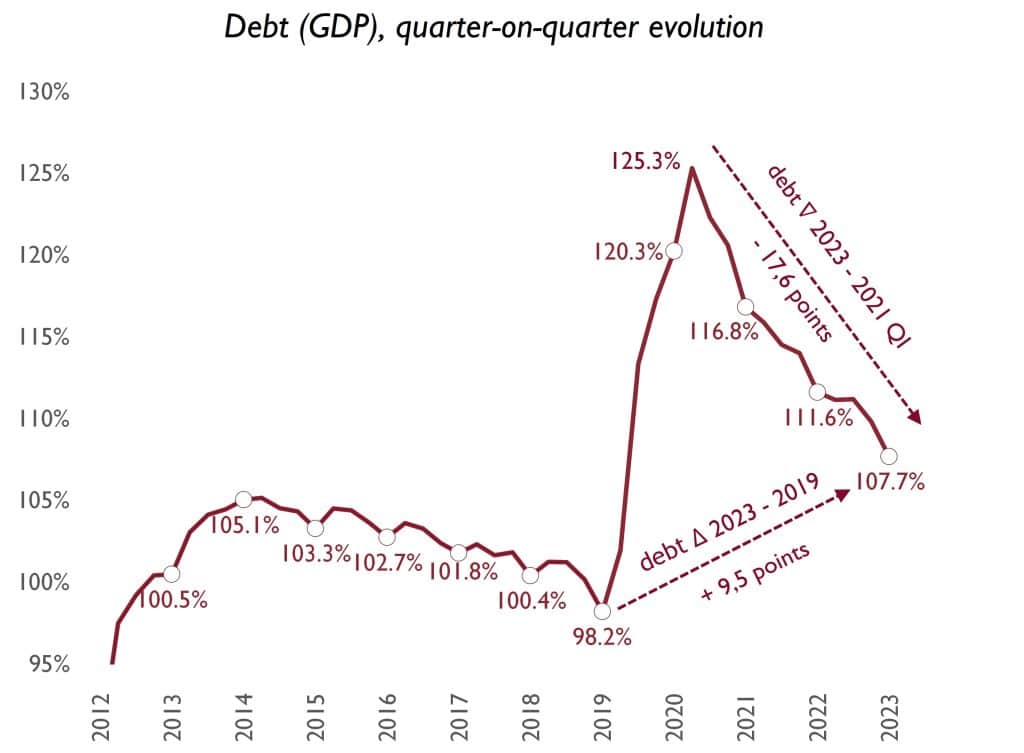

- The Independent Authority for Fiscal Responsibility (AIReF) publishes the Debt Monitor, in which it reviews the evolution of public debt in 2023, which closed at 107.7% of GDP, a reduction of 3.9 points over the year, although it remains 9.5 points above the pre-pandemic level

- According to AIReF’s estimates, the reduction in the ratio in 2023 is mainly due to a major contribution from the GDP deflator. The contribution of growth to the fall in the ratio was 8.8 points, of which 2.6 points were due to real growth, and 6.2 points to the deflator. Fiscal factors contributed an increase of 4.9 points

- AIReF estimates that approximately two-thirds of the increase in debt caused by the pandemic has been corrected thanks to real economic growth and, in particular, much higher than expected inflation

- AIReF’s macro-fiscal forecasts project a reduction in the debt ratio of 1.4 points of GDP for 2024 on the level recorded in 2023, which would place the ratio at 106.3% at the end of the year

- AIReF updates the long-term sustainability analysis, taking into account the proposal for the new EU economic governance framework, after the trilogue negotiation between Parliament, the Council Presidency and the Commission concluded

- While awaiting the final wording of the reform, AIReF has been carrying out tentative exercises to illustrate the necessary adjustment, which it estimates at 0.64% of annual GDP over the period 2025-2028

- This adjustment would allow Spain to maintain a plausible downward debt path and comply with the deficit and debt safeguards

- AIReF will publish an Opinion on the new European framework once the final texts are known

The Independent Authority for Fiscal Responsibility (AIReF) published the latest Public Debt Monitor on its website today, in which it analyses the recent evolution of public debt in Spain, which stood at 107.7% at the end of 2023, a reduction of 3.9 points over the year and an increase of 9.5 points on the pre-pandemic level. The quarterly profile shows a downward path over the last eleven quarters, with a cumulative reduction of 17.6 points from the peak reached in the first quarter of 2021 (125.3%).

The reduction in the ratio in 2023 was significant and was mainly due to a high contribution from the GDP deflator. The contribution of economic growth to the fall in the ratio was 8.8 points, of which 2.6 points came from real growth, and 6.2 points from the deflator. For their part, fiscal factors (mainly deficit) contributed an increase of 4.9 points, 0.6 points of GDP less than in the previous year.

The evolution of debt in 2023 was in line with the latest forecasts of the various national and international organisations, including AIReF, which estimated a fall in the ratio of between 2.7 and 3.8 points of GDP for 2023 during the different forecast windows.

AIReF notes that debt has followed a downward path following the sharp increase caused by the pandemic. The reduction of the deficit and much higher than expected inflation have managed to correct approximately two-thirds of the increase in debt caused by COVID-19. Of the 9.5 points of increase in the ratio over the last four years, fiscal factors (deficit plus other changes in debt) have made a positive contribution of 28.1 points. This has been partially offset by the contribution of nominal growth (18.7 points), where the GDP deflator has contributed 14.9 points and real growth 3.8 points.

AIReF’s macro-fiscal forecasts project a reduction in the debt ratio of 1.4 points of GDP for this year on the level recorded in 2023, which would place the ratio at 106.3% at the end of 2024. This forecast is in line with the forecast presented by the Government in the draft Budgetary Plan for 2024, and is in the range of the latest forecasts of the IMF (104.7%) and the European Commission (106.5%). The public deficit will continue to contribute to the increase in debt, albeit with a slightly lower contribution than in 2023, and the reduction in the ratio will be mainly supported by the nominal growth in GDP, where the deflator will continue to make a significant contribution.

Debt financing conditions

The Monitor highlights the favourable evolution of inflation in 2023, which is close to the reference levels of the Central Banks, although the final correction to 2% is expected to be much more gradual. This favourable evolution of the price level has allowed Central Banks to slow down the tightening of monetary policy after 18 months of continuous interest rate hikes. Supported by the favourable evolution of inflation and the expected moderation in economic activity, investor expectations have stabilised around a scenario of official rate cuts that would begin in the second quarter of the year. For their part, the monetary authorities are also hinting at cuts in 2024, but with greater caution until there is a higher degree of confidence in inflation returning to the target level.

Following the sharp increases in sovereign debt yields in 2022, the expected end of the rate hike cycle led to a correction in the last part of the year. After two years in which the yield on Spanish debt had accumulated an average increase of 450 points, there was a correction of around 100 points. 2024 has begun with a slight upturn, readjusting part of the sharp fall recorded in the last part of 2023. The spread of Spain’s 10-year bond against the German bond has returned to below 100 points, falling by 25 points from the 115 points recorded in October.

Meanwhile, the average cost of new Treasury issues rose in 2023 to 3.44%, a value not recorded since 2011. This has generated a turning point in the average cost of the State debt portfolio, which has increased from its historical low of 1.64% to 2.09%.

In this context, total General Government interest expenditure has increased by just over €8.5bn from the minimum recorded in 2020, to a figure of €33.76bn in the third quarter of 2023. Even though the Treasury has had to place its debt at higher rates, lower inflation has allowed expenditure to grow at a more moderate rate in 2023 (around 6%), compared with the strong upturn in 2022 (21%). The financial burden measured as a percentage of GDP stands at 2.3% of GDP, due to the gradual transfer of higher issue rates and the strong growth of the economy.

According to the AIReF Monitor, the new interest rate environment implies a vulnerability for the sustainability of public finances, given the high debt that will have to be refinanced at significantly higher rates.

For 2024, the Public Treasury proposes reducing net issues by €10bn to €55bn. Gross issuance is expected to be €25.57bn, about 2% higher than in 2023, although as a percentage of GDP it remains at 17%, a relatively low ratio by historical standards, representing a low refinancing risk. In 2024, the Treasury will continue to receive funds from the Next Generation EU programme and to promote the diversification of the investment base in a context of a reduction in the European Central Bank balance sheet. The noteworthy trends observed in debt distribution in 2023 include the high interest of households in Treasury Bills and the demand of foreign investors, who have increased their holdings of State Debt.

Reform of fiscal rules

The AIReF Debt Monitor also updates the long-term debt sustainability analysis, taking into account the proposal to reform the EU’s economic governance. This reform has come a long way from the launch of the first public consultation by the European Commission in February 2020 up to February 9th, 2024, when the trilogue negotiation between Parliament, the Council Presidency and the Commission finally concluded.

Although it will be necessary to wait for the final wording of the reform, medium-term Fiscal-Structural Plans become the main element setting out the fiscal strategy for each Member State. These Plans must be submitted no later than September 20th, 2024. According to the aspects already consolidated, a country whose debt exceeds 60% must ensure in its Fiscal Plan that:

- once the adjustment period is over, the debt trajectory remains on a plausible downward path

- the deficit is reduced and kept below 3%

- the annual effort is at least proportional during the adjustment period and greater than a certain size

- the debt is reduced during that same period and the structural deficit does not exceed a certain threshold.

AIReF has been conducting exercises to illustrate the adjustment that would need to be made. In this regard, according to the macro-fiscal projections of the October 2023 Budgetary Plan, an annual linear adjustment of 0.64 points of GDP over the period 2025-2028, up to a cumulative total of 2.56 points, would meet the requirements of the new framework. This adjustment would allow Spain to maintain a debt trajectory on a plausible downward path and comply with the deficit and debt safeguards.