- Spain’s population will reach 50.3 million in 2050 and 52.1 million in 2070 due to immigration, with a profound transformation of the structure by age, which would bring the dependency ratio to 51.4% and 45.9% in 2050 and 2070 respectively

- In a hypothetical baseline scenario, without economic policy measures or fiscal rules, ageing could push debt to 186% of GDP in 2070 and the deficit to 7% of GDP in the same year

- Spending on pensions would start to accelerate especially from 2035, with a peak of 16.3% of GDP in 2049

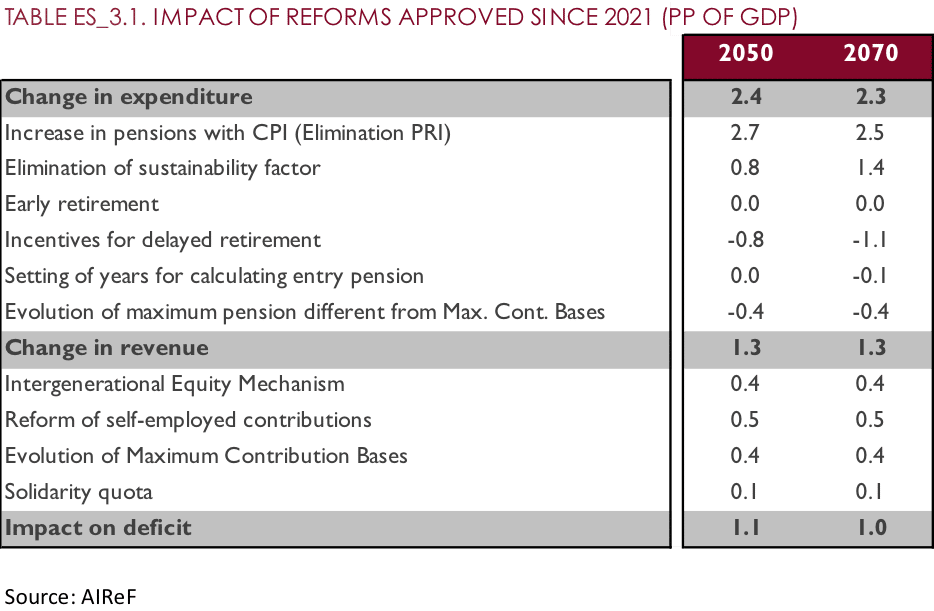

- The pension reforms approved between 2021 and 2023 mean an increase in the deficit of 1.1 points of GDP in 2050 and one point in 2070

- Healthcare expenditure would stabilise at around 8.4% of GDP as from 2049, while long-term care expenditure would stabilise at around 2% as from 2060. In contrast, spending on education would fall to 3.6% in 2041 and return to 4.2% of GDP in 2070

- To illustrate the uncertainty of these projections, AIReF sets out a risk analysis and three alternative scenarios: one with higher potential growth, another with a new fiscal framework and a third with changes in revenue and expenditure

- It proposes structuring a national medium- and long-term fiscal strategy, with the participation of the entire General Government, that is compatible with growth and accompanied by new analyses of the pension system, healthcare expenditure evaluations and a broad evaluation of the Recovery Plan

- In addition, it proposes ensuring the consistency of fiscal rules, including that of pension expenditure. AIReF will evaluate compliance, but this is a spending rule defined in “net” terms, which makes it necessary to evaluate both the revenue and expenditure measures adopted. AIReF will also update this Opinion to provide an independent analysis on sustainability

- As a result of these analyses, AIReF will publish a Monitor of the long-term sustainability of the General Government (GG) on its website today, which will allow different scenarios to be simulated

The Independent Authority for Fiscal Responsibility (AIReF) today published its first Opinion on the Long-Term Sustainability of the General Government, in which it analyses the impact of demographics on public finances. AIReF thus fulfils one of its main missions: to ensure effective compliance with the principle of the financial sustainability of the General Government. In the Opinion, AIReF highlights the high level of pressure brought by the ageing of the population on public finances, with a significant impact on expenditure items such as pensions, healthcare and long-term care and its consequent impact on the public deficit and debt. For AIReF, sustainability is one of the major challenges for Spain and should be addressed from a comprehensive perspective.

AIReF believes that exercises with a comprehensive and long-term outlook based on objective and independent data and projections are key for debate and decision-making. Despite the uncertainty inherent to such long-term projections, they are very useful exercises. Moreover, they are especially important at the present time, given the pressure already exerted on the public accounts by the ageing population, the country’s vulnerability due to the high level of structural debt and deficit and as a result of the reform of the European fiscal framework, which will be based on sustainability.

The Opinion completes and updates AIReF’s previous statements on the sustainability of the Social Security system with a comprehensive overview of the GG as a whole. AIReF puts forward a hypothetical baseline scenario in which there are no fiscal rules or economic policy response. The estimates presented in this Opinion should in no case be interpreted as forecasts as they do not take into account phenomena other than demographics that will certainly affect growth and the accounts over that time horizon, such as climate change, technological advances and the application of fiscal rules. In addition, the baseline scenario is dependent on certain assumptions about the medium- and long-term growth of the economy that are subject to a high degree of uncertainty. These include the effect of demographic change on the behaviour of agents and the effect of the Recovery, Transformation and Resilience Plan (RTRP). Finally, this long-term exercise does not include economic cycles.

Baseline scenario

In AIReF’s baseline scenario, the population in Spain will reach 50.3 million in 2050 and 52.1 million in 2070. This increase in the population is mainly due to the dynamism of migration, with average annual net inflows of around 235,000 people between 2020 and 2050 and almost 339,000 people in the period 2051-2070. Migration thus plays a crucial role and mitigates the effects of negative natural population change.

The ageing of the population cohorts born in the 1960s and mid-1970s in Spain, the reduced fertility rates of recent decades and the increase in longevity cause a profound transformation of the population structure by age, with a decrease in the relative weight of the population of working age from the end of this decade – with some delay compared with that observed in other economies. In this context, the dependency ratio would stand at 51.4% and 45.9% in 2050 and 2070, respectively, compared with 26.6% today.

To construct the macroeconomic scenario, AIReF uses its latest published medium-term scenario, estimated up to 2026. In the longer term, it assumes average annual GDP growth of 1.3% in real terms and 3.3% in nominal terms between 2027 and 2070. In a context of a shrinking working-age population, sustaining this potential growth of the economy implies apparent labour productivity growth of 1.1% in the projection horizon. Moreover, lower labour abundance would lead to a gradual decline in the unemployment rate to 7% by 2050. The participation rates of women, the elderly and young people are expected to increase to converge at European levels.

On the basis of the demographic and macroeconomic scenario, AIReF builds a baseline fiscal scenario from 2026 – the year up to which AIReF’s medium-term scenario is used – in which the fiscal rules would not operate. This scenario shows an increasing deficit from 2026 to a peak of 8.1% of GDP in 2055, to then fall to 7% in 2070. This path is mainly explained by the spending pressures of ageing coupled with rising interest expenditure as debt levels increase. The debt would follow an upward path throughout the period until reaching a peak of 186% of GDP in 2070.

The weight of revenue over GDP would rise in the absence of economic cycles in the projection to 44.7% in 2050 and 45.6% in 2070, from 43.5% in 2021. Expenditure would rise to a peak of 53% of GDP in 2058 and then stabilise, falling to 52.6% in 2070. Firstly, this evolution would reflect the pressure from the ageing process, which is not only reflected in pension expenditure, but also in expenditure on healthcare, education and long-term care. Secondly, the dynamics of debt accumulation coupled with rising interest rates would also increase the weight of interest expenditure to reach 6.9% of GDP in 2070.

Pension expenditure would start to accelerate especially from 2035 onwards, reaching a peak in 2049 of 14.8% of GDP for social security pensions and 16.3% including non-contributory and civil servant pensions. Subsequently, once the pressures of ageing have eased, expenditure would fall to 13.4% and 13.9%, respectively, in 2070. These projections, which update the latest ones published by AIReF in 2020, incorporate the latest available data and changes in the starting assumptions. They also include the impact of the reforms approved between 2021 and 2023, which mean an increase in the deficit of 1.1 points of GDP in 2050 and one point in 2070.

In addition, ageing would imply a similar evolution in healthcare and long-term care. In healthcare, spending would stabilise at around 8.4% of GDP from 2049, while in long-term care it would stabilise at close to 2% by around 2060. In contrast, expenditure on education falls to 3.6% in 2041 and then recovers to 4.2% of GDP in 2070.

Alternative scenarios

To illustrate the uncertainty of these projections, AIReF sets out three alternative scenarios with higher potential growth, a new fiscal framework and discretionary changes in revenue and expenditure.

In the first, AIReF assumes average annual economic growth that is 0.3 points higher than the baseline scenario, given the uncertainty surrounding this assumption. This higher medium-term growth is driven by the labour market, productivity and migration. In this scenario, pension expenditure would fall to 13.5% of GDP in 2050, 1.3 points below the baseline scenario. More generally, the public deficit would moderate to a peak of 5.4% in 2053 and fall to 2.7% in 2070. In turn, this would imply lower interest expenditure and a lower level of public debt that, after reaching a peak of 126% in 2060, would progressively fall to 117% by 2070.

In the second scenario, AIReF takes into account the European Commission’s proposal on the reform of fiscal rules whereby countries would take on medium-term spending commitments that guarantee a downward debt path, incorporating the effects of ageing. A quantification of the commitments that would need to be made if the EC proposal were to materialise – according to AIReF’s interpretation – suggests that the adjustment required to meet the debt reduction commitment would lie in a range of between 0.32 and 0.43 GDP points per year depending on the parameters used.

Thirdly, AIReF puts forward a scenario with changes in the evolution of revenue and expenditure subject to the set of discretionary decisions taken by governments to develop public policies. Illustratively, a structural reduction in the deficit, via revenue or expenditure, of one additional point from 2027 would result in a reduction of 25 points of GDP in debt in 2050 and 47 points in 2070. In the opposite direction, a structural increase in the deficit, via revenue or expenditure, of one additional point from 2027 would result in an increase of 25 GDP points of debt in 2050 and 47 points in 2070.

AIReF also presents a sensitivity analysis showing the impact of changes in the key variables. In this regard, a 15% reduction in migratory flows would increase debt by 28 points, while an increase in flows by a similar amount would reduce it by 25 points in 2070. The impact associated with lower revenue elasticity relative to nominal GDP has also been explored. This will keep the weight of revenue over GDP constant, which would raise debt by 85 points. Another element with a major impact on debt projections, given the high levels of this variable both in the starting situation and throughout the horizon considered, is the level of interest rates. In particular, an increase of 50 basis points over the full horizon of the exercise would raise the debt ratio by 30 basis points in 2070, while a parallel reduction would reduce debt by 25 basis points.

Proposals

In this context, AIReF considers it necessary to open a process of reflection, both across society as a whole and internally in each public authority on how to meet the challenges of the sustainability of the GG. The holding of different elections over the course of this year should not be an obstacle to this process, quite the opposite. The start of a new legislature is a window of opportunity to begin to implement less short-term approaches, which will lead to a healthier public accounts position. Therefore, AIReF proposes structuring a national- medium and long-term fiscal strategy with the participation of all tiers of government that includes a comprehensive reform of the national fiscal framework to ensure the sustainability of the GG.

AIReF also considers that the pressure that ageing will exert on public accounts and, in particular, on pension and healthcare expenditure should lead to a more in-depth analysis and evaluation of its determining factors, as well as the effect of any reforms that may be implemented. In the case of pensions, the reforms and developments of the system must be studied both from the perspective of their impact on future spending and sustainability, and from the perspective of sufficiency and contributory and intergenerational equity. In addition, AIReF proposes continuing with the evaluations of healthcare expenditure.

In addition, AIReF points out that the new pension expenditure rule introduced by Royal Decree-Law 2/2023 shows design weaknesses, such as the lack of justification of the chosen quantitative limits, the lack of coherence with the fiscal framework and the restrictions imposed on independent supervision by AIReF. AIReF announces its intention to accompany the report provided for in the Royal Decree-Law with an update of this Opinion to provide institutions and society with an independent and detailed analysis of the position of public finances as an objective element for decision-making. In addition, AIReF proposes that the Government ensure coherence and consistency between all fiscal rules, that representatives of the institution attend the sessions of the Working Group on Ageing as observers and an agreement be established between AIReF and the Government for the implementation of the pension expenditure rule, among other proposals.

AIReF also proposes designing a governance model for evaluating the RTRP over the coming years and preparing a report on specific fiscal risks that sets out the possible risks that may affect fiscal projections. Once the fiscal risks have been identified and analysed, it is important to assign probabilities to their materialisation and to quantify their impact. Furthermore, the risk mitigation strategy should be made explicit, either for the risks as a whole or for individual risks.

Monitor of the long-term sustainability of the General Government

As a result of the analyses carried out in the Opinion on Sustainability, AIReF will publish a Monitor of the long-term sustainability of the GG on its website today in which different scenarios and their implications for sustainability can be chosen. It also updates the population pyramid, which can also be consulted interactively on the institution’s website.