- The Independent Authority for Fiscal Responsibility maintains the year-end 2022 LG surplus at 0.2% after publication of the latest data

- The LG surplus is marked by the settlements of the financing system and the compensation between 2022 and 2024 for the negative settlement of 2020

- In the medium term, the LG surplus will grow again in 2024 to 0.6% of GDP and will subsequently fall to 0.3% in 2026

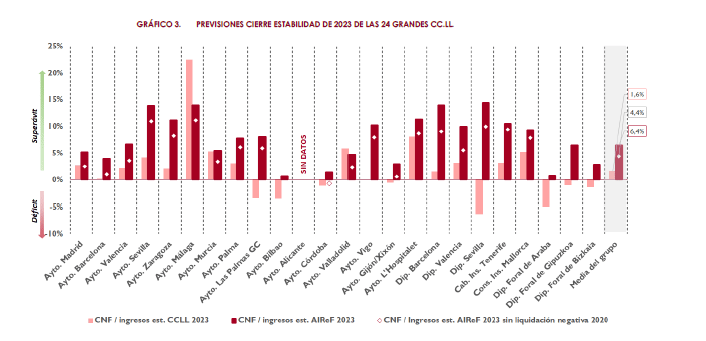

- According to AIReF’s estimates, in 2022 the group of the 24 large LGs under analysis will achieve a significantly lower surplus than in 2021, mainly as a result of the full allocation in that year of the aforementioned negative settlement of 2020

- For 2023, AIReF expects the group of 24 large LGs to reach an overall surplus of over €1.5bn, three times higher than reported by the LGs

- According to AIReF’s estimates, nine of the large LGs will close 2022 with a deficit, while it does not expect any of them to incur a deficit in 2023

The Independent Authority for Fiscal Responsibility (AIReF) today published on its website Individual Reports on the Draft Budget and Main Budgetary Lines of the Autonomous Regions for 2023 and the Report with the Individualised Analysis of the Local Government (LGs). AIReF estimates a surplus in 2023 of 0.5% of GDP for the LGs, after reaching 0.2% in 2022.

Similarly to the ARs, the evolution of the surplus is marked by the settlements of the financing system in addition to the compensations between 2022 and 2024 as a result of the negative settlement of 2020. Consequently, the surplus of the LGs will grow again in 2024 to 0.6% of GDP and will subsequently fall to 0.3% in 2026.

AIReF has updated the projected outcome for the end of 2022 for all LGs in light of the latest published data. Having analysed these new figures, AIReF maintains for the end of this year its forecasts for the local sub-sector of a surplus of around 0.2% of GDP, although with a slight improvement compared with its July forecasts. This is due to the improved performance of local revenue, mainly that resulting from economic activity, despite the negative impact of the allocation to the year of the full amount of the negative settlement of the State financing system for 2020, of over 0.2 points of GDP. The 0.2% year-end figure is higher than the 0.1% forecast by the Government in the Budgetary Plan.

For 2023, AIReF forecasts that the LGs will achieve a surplus of 0.5% of GDP, 0.4 points higher than the forecasts in the Budgetary Plan and the reference rate set for the year. The local balance of 0.5% results from an expected annual growth in expenditure of slightly more than 2%, well below the expected growth in revenue of almost 7%. This estimated result for 2023 improves on that expected for 2022 by almost 0.3 points of GDP. However, net of the effect of the 2020 settlement of the financing system, the estimated surplus of 2023 would be very similar (around 0.3% of GDP).

AIReF estimates that in 2022 the group of large LGs will achieve a significantly lower surplus than in 2021, mainly as a result of the full allocation in that year of the aforementioned negative settlement of 2020. Without that effect, the group’s surplus would amount to €1bn. These AIReF forecasts exceed those reported by the LGs.

For 2023, AIReF estimates a surplus of over €1.5bn, three times higher than that reported by the LGs, as it expects a higher growth in their revenue linked to economic activity and the positive effect of the compensation of the part to be paid in the year of the aforementioned settlement. This also means that the group of large LGs would also exceed the reference rate set for both the sub-sector as a whole and in the case of the provincial councils of the Basque Country.

According to AIReF’s estimates, nine of the large LGs will close 2022 with a deficit, including the impact of the settlement. Noteworthy among these due to their high percentage over revenue are the deficits estimated for the Island Council of Tenerife and the City Council of Barcelona. The City Councils of Madrid, Murcia, Cordoba, Valladolid and Gijon and the Provincial Councils of Valencia and Seville will also close with deficits. 13 of the 24 large LGs expect to run deficits this year although most have not included the impact of the settlement in their forecasts.

For 2023, AIReF does not expect any of them to incur a deficit, as it estimates an improvement in revenue linked to economic activity and includes the positive effect of the 2020 settlement. For their part, only three of the large LGs under the ordinary regime estimate a deficit, as well as the three Provincial Councils of the Basque Country in 2023.

According to the estimates of the LGs, the year-on-year growth in eligible expenditure of the group of large LGs would reach an average of 12% in 2022, although the Provincial Councils of the Basque Country forecast an increase of 20%, the Island Council of Tenerife 50%, the City Council of Vigo almost 30% and the City Council of Cordoba 22%. This growth includes the increases resulting from the execution of expenditure with surpluses from previous years in a context of an absence of targets, amounting to almost €1.5bn, according to the data from the LGs.

The local results expected by AIReF in 2022 and 2023 may be affected by the existing uncertainties about the actual impact on local revenue of the current regulation of the Tax on the Increase in Value of Urban Land and/or the amount of expenditure that can be carried out in application of the surpluses, as well as the greater or lesser degree of substitution that said spending entails in relation to expenditure financed with other revenue.

Finally, the recommendation to the Ministry of Finance and Civil Service, included in the report of October 25th, to adapt the deficit/surplus reference rates to the actual situation of the different public authorities, is noted at the local level due to the decoupling between the rates set and the situation of the different LGs. At the local level, the surpluses observed since 2012 far exceeded the rates or targets set. The same is true of those forecast for 2022 and 2023. In the case of the Provincial Councils of the Basque Country, from 2020 to 2023 they have always been set deficit rates, despite the fact that their results, with the exception of 2020, have been in surplus.

For all these reasons, AIReF has insisted on the need to define reference rates for each public authority, taking into account their starting situation, so that they are both demanding and achievable.