- The regions will close 2022 with a public deficit of 1% of GDP, a figure higher than that estimated in July

- The improvement in the balance in 2023 is explained by the sharp increase in interim payments and the positive settlement of the financing system after a year of negative settlement that more than offset the withdrawal of extraordinary State transfers and the increase in expenditure

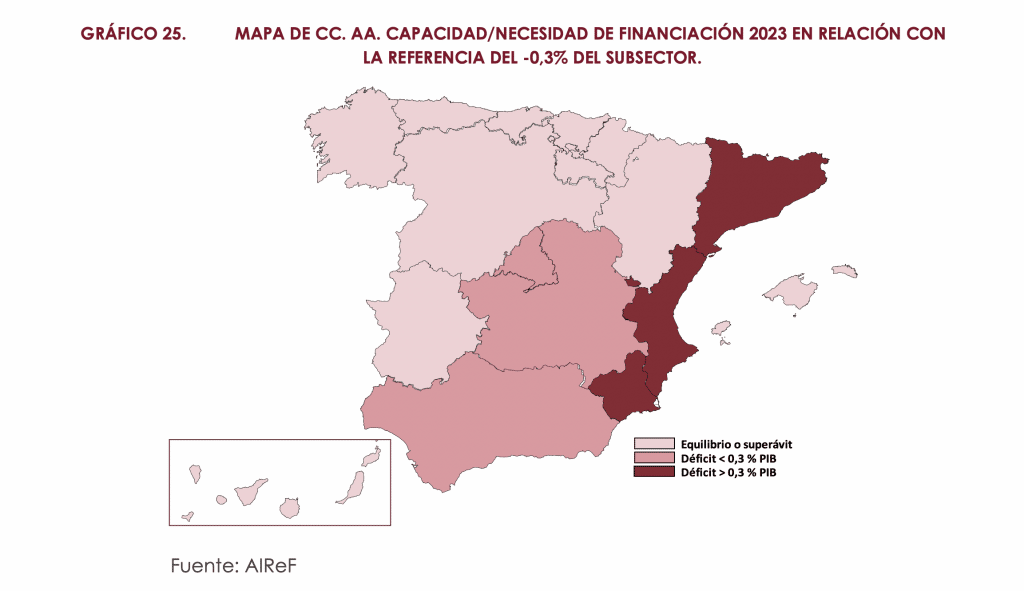

- At an individual level and under the new forecasts, eight ARs will close 2022 with a deficit higher than the reference rate, while in 2023 most will close with a surplus or balanced budget. Most of the ARs expect to reach the reference set in 2023

- In the medium term, AIReF estimates a short-term surplus for the ARs in 2024 of 0.4% of GDP, which will fall until they reach a balanced budget in 2026

- This path is the result of the irregular evolution of the revenue from the financing system, which will provide extraordinary revenue of a temporary nature in 2024 and 2025 for the settlements relating to 2022 and 2023

The Independent Authority for Fiscal Responsibility (AIReF) today published on its website Individual reports on the Draft Budgets and Main Budgetary Lines of the Autonomous Regions for 2023 and the Report with the Individualised Analysis of the Local Governments (LGs). The AR sub-sector as a whole will improve substantially in 2023, reaching a deficit of 0.1% of GDP after closing 2022 at -1% of GDP.

The forecast of a 1% deficit for 2022 has been increased compared with the report of July 15th. From the execution data observed to date, the final year-end 2021 figures, the information provided by the regions and the latest measures, revenue and, to a greater extent, expenditure, have been revised upwards, in both cases without considering the Recovery, Transformation and Resilience Plan (RTRP).

In 2022, AIReF forecasts higher collection from tax revenue – mainly from Transfer Tax and Stamp Duty – and from European funds. At the same time, AIReF raises its forecast for expenditure, mainly current expenditure, recording, among other items, the recently approved update of the basic remuneration of public employees. The Regions have generally worsened the estimates for 2022 provided for the previous report, by 0.2 points for the sub-sector as a whole, to -0.9%. However, they do not incorporate the recent wage update.

In 2023, the overall balance of the sub-sector will improve by 0.9 points according to AIReF’s estimates. This improvement is mainly due to the exceptional increase in revenue from the financing system, up by 23.9%, driven by the growth of interim payments and, to a greater extent, by the settlement which is again positive after the exceptionally negative value of 2022. Overall, AIReF estimates a 10% year-on-year increase in non-RTRP regional revenue, which, under 5% growth in non-Plan expenditure, would allow the sub-sector to close with a deficit of 0.1% of GDP. For their part, the forecasts of the ARs for 2023 are in line in 15 of the 17 ARs with the corresponding reference rate, -0.3% for those under the ordinary regime and -0.6% for the Basque Country and Navarre, resulting in a deficit forecast for the sub-sector of -0.3%.

Individual forecasts

At an individual level and under the new forecasts, eight ARs would end 2022 with a deficit higher than the reference of -0.6% of GDP set for the sub-sector, and nine with a similar or more favourable balance, which in Navarre and the Basque Country is expected to be a surplus. With respect to the July report, the year-end forecasts for 13 ARs worsen. The execution data to date, the incorporation of the latest measures approved by the Central Government and the information provided by the ARs have led to the revision of expected revenue and expenditure at the end of 2022. Consequently, the forecasts for Andalusia improve, while they worsen in Aragon, Asturias, the Balearic Islands, Cantabria, Castile and Leon, Castile-La Mancha, Catalonia, Extremadura, Madrid, Murcia, Navarre, Rioja and Valencia.

In 2023, on the other hand, 12 ARs (Aragon, Asturias, the Balearic Islands, the Canary Islands, Cantabria, Castile and Leon, Extremadura, Galicia, Madrid, Navarre, the Basque Country and Rioja) could close the year with a surplus or balanced budget, or with a limited deficit such as Andalusia. Castile-La Mancha could reach a balance close to the reference indicated for the sub-sector and Catalonia a slightly higher deficit. For Murcia and Valencia alone, AIReF continues to estimate deficits of more than 1% of regional GDP.

Medium-term forecasts

In the medium term, AIReF estimates a short-term surplus in 2024 of 0.4% of GDP, which will fall until a balanced budget is recorded in 2026. The improvement in the balance in 2024 would be of a temporary nature since it is supported by the exceptionally positive settlement of the financing system. Subsequently, the balance will deteriorate, recording a surplus of 0.2% in 2025 and a balanced budget in 2026.

In this period, the revenue of the ARs will show an irregular profile as a result of the settlements of the financing system. In 2024 and 2025, there will be short-term revenue caused by the growth in collection in 2022 and 2023 above that forecast in the Budget. After strong growth in 2023, AIReF forecasts that this revenue will grow by over 13%, after incorporating the effect of the tax reduction measures approved by some ARs. In 2025 and 2026, the increase in interim payments will be more moderate and the net settlement will fall to a more normal level in 2026. As a result, the system’s revenue will grow at rates of 1.3% and 2% in 2025 and 2026, respectively.

- REPORT ON THE MAIN LINES OF THE BUDGET 2023 OF THE AUTONOMOUS COMMUNITY OF ANDALUSIA SPANISH VERSION

- REPORT ON THE MAIN LINES OF THE BUDGET 2023 OF THE AUTONOMOUS COMMUNITY OF CATALONIA SPANISH VERSION

- REPORT ON THE MAIN LINES OF THE BUDGET 2023 OF THE AUTONOMOUS COMMUNITY OF CANTABRIA SPANISH VERSION