- The Independent Authority for Fiscal Responsibility notes that debt ratios have started to fall, although six euro area countries remain above 100%

- In Spain, AIReF estimates a further reduction in the ratio in 2023 due to the growth in nominal GDP

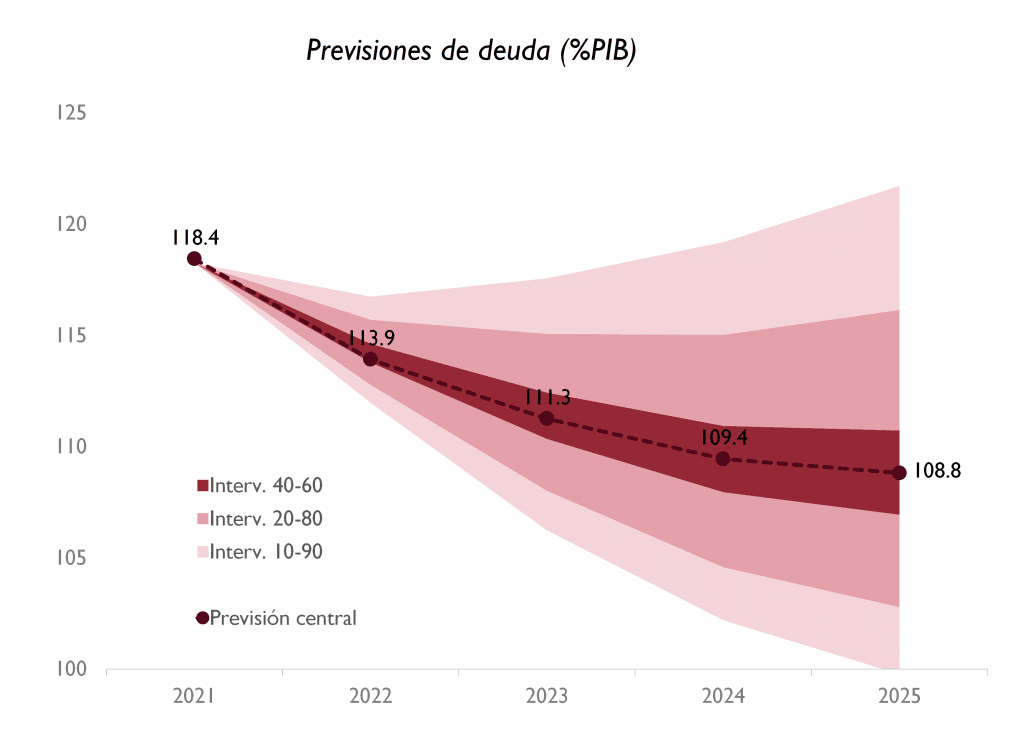

- The pace of reduction in the debt ratio is projected to slow down in the medium term for it to stabilise at 108.5% of GDP

- In the long term, once the boost in growth from the rebound in activity following the shutdown during the pandemic ends and prices return to their historical average, the debt ratio will return to an upward path in the absence of further measures

The Independent Authority for Fiscal Responsibility (AIReF) today published the new Debt Monitor on its website, in which it states that its projections paint an unfavourable trend in the medium- and long-term debt ratio under a no-policy-change scenario. AIReF projects that the pace of reduction in the debt ratio will slow down in the medium term and it will stabilise at 108.5% of GDP. In the long term, once the boost in growth from the rebound in activity following the shutdown in the pandemic ends and prices return to their historical average, the debt ratio will return to an upward path in the absence of further measures.

AIReF’s Debt Monitor begins by noting that the leading indicators continue to reflect the slowdown in global economic activity, given the persistence of inflationary pressures, the tightening of financial conditions and the war in Ukraine. October’s leading indicators confirm the outlook of a sharp slowdown in activity in Q4 this year and a recession scenario in Europe and the US in 2023. This economic context has led various international organisations to revise the economic outlook for 2023 downwards. At present, forecasts show that about 30% of economies could be in recession in 2023.

Persistently high inflation has forced central banks (except Japan) to intensify the tightening of their monetary policy in order to control inflation, anchor consumer and business expectations, and avoid second-round effects. The Federal Reserve (Fed) has recorded the fastest pace of interest rate hikes since the 1980s and the European Central Bank (ECB) raised interest rates by 0.75 points for the second consecutive month, bringing them to 1.5% (deposit rate) and 2% (refinancing rate), the highest level since late 2008. This tightening of monetary policy is leading to sharp upturns in global sovereign debt yields, with a trend that has accelerated over the year. And this increase in yields has gone hand-in-hand with a very significant increase in their volatility, with sharp movements and overreactions in the markets.

In this context and following the sharp increase in global debt as a result of measures to address Covid-19, debt ratios have started a path of reduction based on significant nominal growth. Nevertheless, in the euro area, six countries continue to have ratios above 100% (Greece, Italy, Portugal, Spain, France and Belgium), with the euro area as a whole being very close to that value (94.2%).

According to AIReF, the adoption of further fiscal measures in different countries aimed at reducing the impact of record high inflation, together with weakened real growth in the coming quarters, may endanger the reduction of global debt ratios close to all-time highs. These measures, according to AIReF, should be temporary and highly targeted in favour of the households and companies most vulnerable to rising energy prices, as dictated by the Country Specific Recommendations (CSRs) for high debt countries.

The debt ratio peaked at 125.7% in the first quarter of 2021, a rise of 27.5 points on the pre-pandemic level. Since that turning point, it has recorded five consecutive quarters of falls, which amount to a total of 9.6 points, bringing the ratio to 116.1% of GDP in June 2022. The net increase compared with the end of 2019 is 17.9 points. According to AIReF, this significant reduction is mainly due to the denominator effect, given the strong upturn in activity and prices. In fact, in nominal terms, public debt has continued to grow, adding €64.21bn in the first eight months of 2022, to a new all-time high of €1.49tn.

At a sub-sector level, the largest increase was recorded in the Central Government and the Social Security Funds, which have borne 93.5% of the increase in debt in the last two and a half years by financing most of the expenditure associated with the pandemic. The extraordinary transfers and the non-impact of the fall in tax revenues on the interim payments made to the Autonomous Regions (ARs) under the ordinary regime have mitigated the increase in the debt ratio of the ARs. This ratio has only grown by 1.2 points – to 24.9% of GDP – while Local Governments have slightly reduced their debt.

For 2023, AIReF estimates a reduction in the debt ratio of 6.9 points of GDP compared with 2021. The reduction will be mainly supported by the growth in nominal GDP (15.3 points), where the deflator will make a very significant contribution (8.8 points). The public deficit will continue to contribute significantly to the increase in debt. In this context, AIReF considers the debt projection included in the Budgetary Plan for 2023 to be feasible. In fact, AIReF estimates a somewhat higher reduction.

AIReF projects that the pace of reduction in the debt ratio will slow down in the medium term and it will stabilise at 108.5% of GDP. AIReF’s projection of a stabilised primary deficit of around 1%, together with decreasing nominal growth and an increasing financial burden, translates into a slowdown in the rate of reduction in the debt ratio, which in 2026 will be zero.

In the Monitor, AIReF also notes the turning point that 2022 represents in the evolution of debt financing costs, which have gone from the all-time lows recorded in 2020 and 2021 to increases of more than 250 basis points in all sections of the yield curve. According to AIReF, the deterioration in financing conditions will gradually begin to have an impact on the evolution of the debt service, with interest and repayments that will increase. However, the increase in percentage of GDP will not be very significant in the short term. In the short term, an additional rise in sovereign debt interest rates would have a limited impact on the evolution of the debt ratio. However, in the medium and long term, higher interest rates would require a more intense and prolonged fiscal effort.

In the long term, AIReF’s projections show an unfavourable debt ratio trend under a no-policy-change scenario. According to the institution, once the boost in growth as a result of the rebound in activity following the shutdown during the pandemic ends and prices return to their historical average, the debt-to-GDP ratio will return to an upward path in a no-policy-change scenario. This means that a high level of debt, together with higher borrowing rates, will require a sustained structural adjustment to maintain the stabilisation of the debt ratio and containment of the financial burden.

The simulations carried out by AIReF indicate the need to reduce the primary deficit by 0.16 points of GDP per year to keep the debt ratio stable beyond 2026, which would amount to approximately €2.5bn according to the GDP projection for 2026. A scenario involving a further deterioration in financing conditions would result in an increase in the government deficit and debt or the need to make adjustments in other expenditure or revenue items.

Debt of the ARs

AIReF forecasts that the ARs will reduce their level of indebtedness by almost 3 points from 2021 to stand at 23.1% of GDP in 2023. Specifically, four ARs could have a debt ratio of more than 30% (Valencia, Murcia, Castile-La Mancha and Catalonia). And four other ARs could stand at 13% (Navarre, Canary Islands, Basque Country and Madrid).

The draft budgets and budgetary lines presented by the ARs expect to reach the deficit reference set and adjust their debt to said reference. There is therefore a clear risk that excess borrowing will be generated again. Although at the aggregate level, there are no major discrepancies between AIReF’s forecasts and those of the ARs as a whole, in some cases such differences are very significant at an individual level. If the regional forecasts are fulfilled, the medium-term situation at an overall and individual level would be compromised. Setting lax reference rates that are not in line with reality raises the risk of unsustainable decisions in the medium term or, in the short term, may lead to excess borrowing similar to that accumulated at the end of 2021.