- The Independent Authority for Fiscal Responsibility (AIReF) improves the GDP forecast based on the new estimates from INE’s Quarterly Accounts

- It estimates CPI growth of 3.7% in 2023, somewhat lower than projected in the spring, while the GDP deflator is expected to grow by 4.8%

- The extension of the measures implies an increase in the deficit by two tenths of GDP in 2023, compensated by improved economic forecasts and revenue collection

- AIReF projects a reduction in debt of 3.1 GDP points over the level recorded in 2022, to 110.1% of GDP at the end of 2023

- AIReF recommends that the Ministry of Finance propose reference rates of growth of primary expenditure net of revenue measures for the different administrations consistent with compliance with the European recommendation to Spain

- Recommends that the Autonomous Regions and Local Governments avoid structural increases in expenditure or reductions in revenue financed by the temporary increase in revenue that will occur in 2024

The Independent Authority for Fiscal Responsibility (AIReF) published today its Report on Budget Execution, Public Debt and Expenditure Rule 2023, in which it updates its macroeconomic and fiscal forecasts after incorporating the latest data available and the new measures adopted by the Government. AIReF projects that real GDP growth for 2023 could stand at around 2.3%, compared with the 1.9% estimated in the spring, and maintains the forecast for the budget deficit at 4.1% of GDP. The Institution has also published the individual reports for each Autonomous Region (ARs).

The improvement in the estimated growth forecast for 2023 is due to the incorporation of new estimates from the Quarterly Accounts of the Spanish National Statistics Institute (INE), which suggest that the economy maintained a higher growth rate than initially estimated in the second half of 2022 and in the first quarter of 2023. Moreover, the information available for the second quarter points to real growth remaining somewhat lower than in the previous quarter, but higher than in the euro area. The revision of exogenous assumptions has hardly any impact on the revision of the forecast.

According to AIReF, the Spanish economy has weathered the energy crisis better in the last three quarters than the euro area. However, in the second half of the year growth is expected to moderate due to the transmission of interest rate hikes to the real economy, which is expected to materialise fully in the second half of 2023 and in 2024. In addition, persistently high inflation rates in the euro area could lead to a tighter monetary policy stance for a longer period.

In the area of prices, AIReF notes a notable containment of inflation due to the base effects associated with the energy component and the moderation in gas and oil prices on international markets. Nonetheless, core inflation remains high. Overall, it expects CPI growth of 3.7% in 2023, somewhat lower than projected in the spring, while the advance in the GDP deflator amounts to 4.8%.

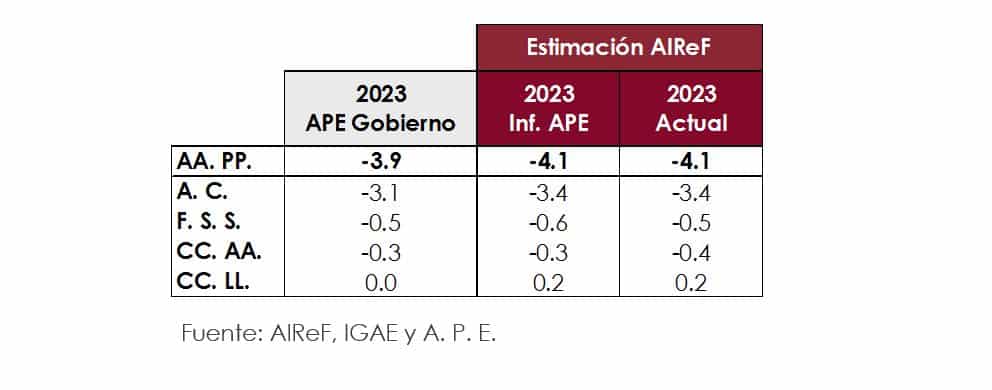

AIReF maintains a forecast general government deficit of 4.1% of GDP in 2023, two tenths of a percentage point above the reference rate set by the Government. The extension of the measures to deal with the rise in energy prices and the effects of the war in Ukraine have led to an increase in the deficit of two tenths of a percentage point of GDP, which is offset by the effect of the revision of the macroeconomic framework on the public accounts and the latest revenue collection data.

As a result, AIReF estimates that the reduction in the deficit in 2023 would be seven tenths of a percentage point of GDP from 4.8% in 2022. Following the approval of Royal Decree-Laws 4 and 5 of 2023, the measures adopted to mitigate the effects of the war and the energy crisis amount to 1.1% of GDP in 2023, three tenths of a percentage point less than in 2022. In addition, the rest of the revenue measures incorporated in the 2023 Budget and in the laws that were approved in parallel, contribute to reducing the deficit by two tenths of a percentage point. On the other hand, the decrease in COVID-related expenditure still contributes one tenth of a percentage point of reduction. Finally, the revaluation of pensions offsets the growth in revenue over and above the inertial evolution of the rest of expenditure.

Revenues will reach 42.7% of GDP in 2023, excluding the Recovery, Transformation and Resilience Plan (RTRP), almost one tenth of a percentage point higher than the level projected in the previous report. This represents a growth of 7.5% compared to the end of 2022. The extension of the reduction in VAT rates means a reduction in revenue of just over 500 million, assuming that underlying inflation will be below 5.5% in September in accordance with AIReF’s macroeconomic scenario. On the other hand, the revision of the macroeconomic scenario and the latest data available on revenue collection imply an increase in revenue forecasts of almost two tenths of a percentage point in social security contributions, corporate income tax and personal income tax. However, this increase in the forecast level is almost entirely offset in terms of weight in GDP by the increase in the estimate of nominal GDP for 2023.

Expenditures, also excluding RTRP, will stand at 46.8% of GDP, less than one tenth of a percentage point above the level forecast in the previous report. On the one hand, the extension of the measures, including the rebate on public transport and fuel prices for professionals, account for one tenth of a percentage point of GDP. In addition, the latest implementation data lead to a slight upward revision in public consumption and social transfers. Overall, AIReF raises the forecast for growth in expenditure to 5.9% compared with the level reached in 2022.

By sub-sectors and with respect to the previous report, the deficit forecast for the Central Government (CG) worsens by less than one tenth of a percentage point, remaining at 3.4% as it assumes the cost of the extension of measures. On the other hand, the Social Security Funds improve their forecast by one tenth of a point, to -0.5% of GDP; the Autonomous Regions (ARs) worsen by almost one tenth, reaching -0.4%; and the Local Governments (LGs) maintain their forecast at 0.2%.

Debt will fall to 110.1%

Following the increase caused by the pandemic, the debt ratio is on a downward trajectory, with eight consecutive quarters of reduction, which has meant correcting approximately half of the increase caused by the pandemic (a total of 12.9 points from the ceiling reached in the first quarter of 2021). In 2023 AIReF projects a decrease in the debt-to-GDP ratio of 3.1 points on the level recorded in 2022, to 110.1%. This reduction would be mainly underpinned by nominal GDP growth, with a high contribution from the deflator. This forecast is in line with the latest projections of the IMF and the European Commission and is slightly more optimistic than those presented by the Government in the Stability Programme (111.9%).

In the medium term, the new monetary cycle and the high level of existing debt, above 100% of GDP, places the sustainability of public finances in a vulnerable situation, as in the coming years, General Government will have to finance large amounts of debt, around 20% of GDP, at significantly higher interest rates, in a context in which the demand for debt securities by the ECB disappears and in which many countries maintain high levels of debt and refinancing needs.

Recommendations

In this context, AIReF issues a new recommendation addressed to the Ministry of Finance to propose reference growth rates for primary expenditure net of revenue measures for the different administrations, considering the temporary or structural nature of the revenue and expenditure of each sub-sector for 2024, and consistent with compliance with the European recommendation to Spain.

For 2024, AIReF’s forecasts for General Government, which were presented in the Report on the Stability Programme Update, would be compatible with compliance with the 2.6% spending growth limit set by that recommendation, provided that the temporary revenue and expenditure measures of the price crisis are withdrawn. At sub-sector level, this implies that the ARs would close with a surplus of 0.4% and the LGs of 0.3% of GDP.

However, the only existing reference for the preparation of budgets is the forecast contained in the Stability Programme: balance for the ARs and a surplus of 0.2% for the LCs in 2024. This would be compatible with a growth in sub-sector spending, excluding the RTRP and the REACT, of 7% in the ARs and 6% in the LGs, figures that are hardly compatible with compliance with the European recommendation. In fact, if the balances close at these levels, the growth in primary expenditure net of revenue measures for the General Government, excluding the RTRP, could stand at 4%, 1.4 points above the level of the European recommendation.

AIReF also points out that, in view of the general elections, the rest of the administrations will have to start drawing up their budgets before the formal approval of the budget stability targets and the setting of the expenditure rule reference rate. In any case, according to current legislation, the reference rate of the national expenditure rule would be around 3% by 2024.

In this respect, it recommends that the ARs and LGs under the ordinary regime avoid structural increases in expenditure or reductions in revenue financed by the temporary increase in revenue that will arise in 2024 because of the settlement of the financing systems for 2022 and that they take into account the application of the expenditure rule in 2024, even if this means temporarily attaining a surplus. In the case of the ARs and LGs under the foral regime, even though they are not affected by the financing system settlements, given that their forecasts for 2024 are also above the path set for the subsector in the Stability Programme, AIReF recommends that they avoid increases in expenditure or reductions in revenue that do not have permanent financing and that they consider the application of the expenditure rule in 2024.