- The Independent Authority for Fiscal Responsibility estimates real GDP growth of 5.3% in 2022 and 1.6% in 202

- The inflation forecast for 2022 is lowered by 5 tenths of a percentage point to 8.4% due to the recent moderation in energy prices. The CPI forecast for 2023 is raised by 3 tenths of a percentage point to 4.2%

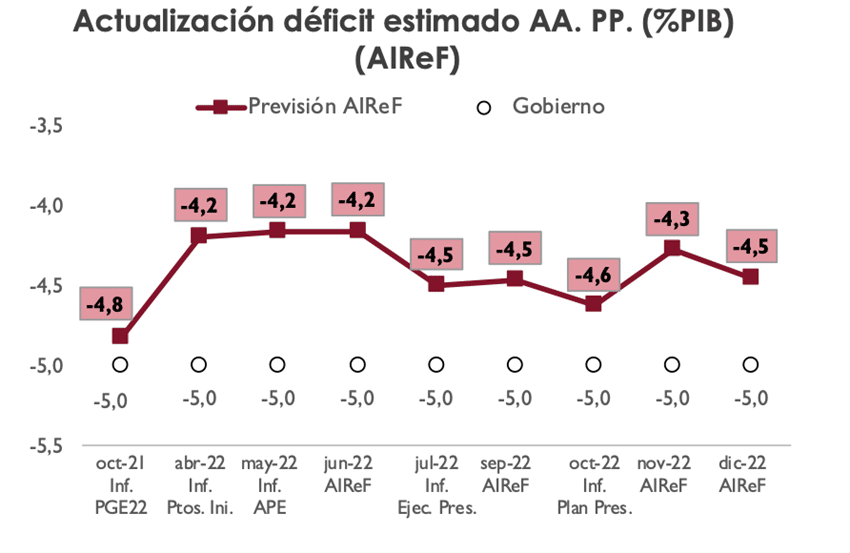

- AIReF has lowered its 2022 public deficit forecast by two tenths of a percentage point to 4.5%, due to the measures approved and the latest data

- By administrations, the changes are concentrated in the central government due to the inclusion of the latest measures, which increase spending, and in the Autonomous Regions due to the higher spending forecast derived from the latest budget execution data

The Independent Authority for Fiscal Responsibility (AIReF) today published on its website the updated GDP growth forecasts for 2022 and 2023 and the monthly monitoring sheet for the budget stability target. AIReF has revised growth for 2022 upwards by nine tenths of a percentage point to 5.3% and by one tenth of a percentage point for 2023 to 1.6%. As regards the deficit, AIReF has worsened its forecast for the general government deficit to 4.5% of GDP in 2022, two tenths of a percentage point higher than the figure published in the previous report due to the implementation of the packages of measures approved and the latest budget execution data.

AIReF’s new macroeconomic scenario incorporates the latest information available and, in particular, the most recent economic indicators, the revised estimates of the Quarterly National Accounts (QNA) for the third quarter and the changes observed in the technical assumptions.

The main source of revision in 2022 comes from the incorporation of new QNA data. It also incorporates a higher growth forecast for the fourth quarter, in line with the results of the MIPred model. Overall, real GDP is expected to grow by 5.3% in 2022.

The better-than-anticipated end of 2022 and the improved assumptions for energy commodity prices in 2023 justify an upward revision of expected growth in 2023.

On the price side, the recent moderation in industrial and energy price increases has led to a faster than expected decline in energy inflation in late 2022. However, the improved developments in energy prices have been accompanied by elements that seem to point to more persistent growth in other CPI components. Taken together, all the factors considered result in an upward revision to the projected rate of change of the CPI in 2023.

This exercise involves an update of the macroeconomic estimates on which AIReF bases its fiscal forecasts in order to take into account the latest information. A more in-depth analysis of the factors that determine growth in the short and medium term will be carried out with a view to the Stability Programme Update report in the spring.

Monitoring of the stability objective

AIReF has lowered its forecast for the general government deficit for 2022 by two tenths of a percentage point to 4.5% of GDP. The sheet incorporates the update of the macroeconomic picture of the Report on the Draft Budgetary Plan and Main Lines of the General Government Budget of 25 October, as well as the new information received on budget execution, including the data on tax collection and contributions.

The pace of deficit reduction in recent months is maintained, with an estimated 3.4% in October. Until the end of the year, it is expected to worsen to 4.5% of GDP at the end of the year due to the spending measures approved. AIReF forecasts an increase in the weight of revenue during the year to 43.9% of GDP. This weight would be lower if the Recovery, Transformation and Resilience Plan (PRTR) were not taken into account. For their part, jobs will end the year with a weight of 48.3% of GDP due to the implementation of the measures and the PRTR.

By government, the changes are concentrated in Central Government due to the inclusion of the latest measures and in the Autonomous Regions due to the higher expenditure forecast derived from the latest budget execution data. Specifically, AIReF has cut the Central Government deficit forecast by one tenth of a percentage point of GDP to 3.1%, four tenths of a percentage point less than the forecast for 2022 in the 2023 Budget Plan. This worsening is due to the fact that the cost of the expenditure measures exceeds the improvement in the revenue forecasts.

The collection

Up to November, tax revenues grew by 15.9%, driven mainly by personal income tax, VAT and corporate income tax, despite the reduction in revenues produced by the measures adopted to mitigate the escalation in electricity prices (-7,466 million up to November). On the other hand, social security contributions continue to show a positive evolution that has led to an improvement in the forecast for 2022.

Specifically, AIReF estimates that the weight of personal income tax will reach 8.3% of GDP at the end of the year, half a point higher than in 2021. Up to November the increase was 16% due to the growth in employment, wages and pensions. This growth, which has slowed since August, recovers slightly in November, influenced by the increase in public employees’ salaries. By the end of the year, revenues are expected to be 16% higher than in 2021.

For its part, corporate income tax will reach 2.5% of GDP in 2022, three tenths of a percentage point more than in 2021. Instalment payments grew by 18.7% in the absence of the third instalment payment in December and growth so far this year stands at 26.8%, despite the fact that exceptional refunds have been made due to a ruling and deferred tax assets, which will still be extended until the end of the year. The increase at the end of the year is estimated at 22.4%.

VAT will account for 6.3% of GDP by the end of 2022, three tenths more than in 2021. Up to November, revenue has grown by 16.2% despite the reduction in the rate on electricity, which has accounted for -1,723 million so far this year. It is worth highlighting the increase in refunds, which reached almost 34%, above gross revenues, which grew by 21.1%. By the end of 2022, the year-on-year growth rate is expected to stand at 14.4%.

For the Special Taxes as a whole, their weight in GDP will be reduced by one tenth of a percentage point compared to 2021, standing at 1.5%. So far this year, revenue has grown by 2.4%, driven mainly by the growth of the Hydrocarbon Tax, the most affected by the pandemic, and reduced by the reduction in the rate of the Special Tax on Electricity which, up to November, is estimated at -1,909 million. The estimated growth at the end of 2022 is 2.3%.

In national accounting terms, total tax revenues in 2022 will be 13% higher than in 2021. The incorporation of the latest available information adds one tenth of a percentage point to the latest estimate. In 12-month cumulative cash terms up to November, revenues grow by 16%. At year-end, growth is estimated at 14.8%, more moderated by including one more month of recovery in 2021, still very much affected by the restrictions on activity in its first months. All figures would make a positive contribution to growth, particularly personal income tax, VAT and corporate income tax.

Social security contributions will end the year with a weight of 12.8% of GDP, according to AIReF’s estimates, one tenth of a point below the November forecast due to the denominator effect of GDP. AIReF increases the expected rate of growth in contributions by 6 tenths of a percentage point to 4.6% due to the dynamism shown by contributions in the latest information received.

AIReF also estimates that the Social Security Funds deficit will reach 0.5% of GDP in 2022, similar to the forecast in the October 2022 Budget Plan. The estimate improves due to the higher forecast for contributions, although the closing figure remains at -0.5%. The regional governments will close 2022 with a deficit of 1.1% of GDP, maintaining the deficit accumulated to October. AIReF’s deficit is one tenth of a percentage point worse as the expected level of employment has increased according to the latest information on budget execution. Lastly, AIReF maintains the forecast for local authorities to close 2022 with a surplus of around 0.2% of GDP, albeit with a slight fall compared with the last estimate, exceeding the reference rate (0%) and the Government’s forecast (0.1%). The current forecast corroborates the October estimate, with a slight worsening, as it incorporates the execution data for the third quarter of 2022.