- The Independent Authority for Fiscal Responsibility (AIReF) notes that the Stability Programme is framed within a transitional context towards new fiscal rules that make the sustainability analysis more important

- AIReF asserts that the design of the SPU aligns that of previous years and does not constitute an instrument for medium-term planning, despite recommendations from AIReF and the European Commission

- It forecasts GDP growth of close to 2% in 2023 and 2024, falling to 1.7% in 1.7% in 2025 and 2026 and considers the Government’s macroeconomic scenario to be feasible

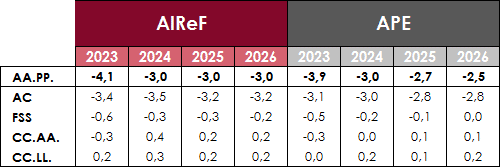

- The deficit stabilises at around 3% of GDP, compared with the gradual reduction forecast in the SPU, to stand at 0.5 points above the SPU forecast by 2026

- AIReF projects a fall in the debt ratio of 5.9 points over the next four years to reach 107.3% in 2026 and consider the Government’s forecasts to be feasible, but envisages a growing ratio in a scenario of inertia in the long term

- The long-term analysis reveals that the stabilisation of the deficit is inadequate to set debt on a downward path and reduce vulnerability

- According to AIReF’s simulations, an additional annual adjustment of 0.46 points relative to its fiscal scenario would set debt on a clearly downward path, even in the most adverse scenario, aligning with the European Commission’s guidelines and with the proposed reform of the fiscal framework. AIReF’s simulations applied to the Government’s fiscal scenario also point to an adjustment, which, in this instance, would be close to 0.3 points annually

- AIReF recommends that work should begin on the reform of the national fiscal framework and proposes an analysis of how to meet the European Commission’s recommendation to maintain debt on a continuous and plausible downward path

- AIReF recommends the design of a governance model to evaluate the RTRP and reiterates its recommendations to improve the endorsement process

The Independent Authority for Fiscal Responsibility (AIReF) published its Report on the Stability Programme Update (SPU) 2023-2026 today, which confirms that the Government is meeting its commitment to reduce the public deficit to below 3% of GDP on the projection horizon although, according to its forecasts, this variable will stabilise at 3% as from 2024. For its part, debt will fall, mainly driven by nominal growth in GDP, both in the Government’s and AIReF’s scenario. However, according to AIReF, in the absence of additional measures, debt will start on an upward curve from 2030. In fact, AIReF estimates that, when the new framework comes into force and if it remains in line with the legislative proposals of the European Commission (EC), additional corrective measures will be required to place the debt path on a downward slope in the coming years with sufficient plausibility, as the new legislation will foreseeably require.

According to AIReF, this year’s SPU is framed in a context of transition towards a new framework of fiscal governance which means that the sustainability analysis of the public finances and of such factors as medium-term growth, demographics and other fiscal risks become more important. The new framework, which must be firmed up in the coming months and will come into force in 2024, is designed with a vocation to strengthen the medium-term direction, placing debt sustainability at its heart. It also proposes targets differentiated by country that each EU Member State must materialise through the so-called Structural Fiscal Plans.

In fact, despite maintaining the escape clause active this year, the European Commission has encouraged the Stability Programmes for the period 2023-2026 to already include the medium-term structural fiscal plans to guarantee that debt remains on a downward and continuous plausible path or at prudent levels, and that the deficit should fall to below 3% and remain below this reference rate at constant policies in the medium term. However, this year’s SPU has followed the same design as in previous years and does not constitute a genuine medium-term planning instrument, as indicated by AIReF on multiple occasions. The commitments and targets are revised year on year, without an analysis of the factors that justify this revision. Nor do the programmes contain details of fiscal measures beyond those approved in the Budget for 2023.

Macroeconomic scenario 2023-2026

AIReF considers that the macroeconomic scenario of the SPU for the period 2023-2026 is feasible, which it thus endorsed on April 28th. The real GDP forecasts, prices and nominal growth stand within the central probability range defined around AIReF’s estimates at current prices and constant prices over the projection period.

According to AIReF, short-term GDP growth continues to surprisingly rise, driven by the relaxation of the pressures on the bottle-neck, less intensive inflationary pressures on energy raw materials and the fiscal policy measures to counteract price hikes. In contrast, the rise in official interest rates can now be seen in the tightening of financing conditions and it is expected that its effects will begin to be felt more intensely in the second half of 2023 and in 2024. Overall, AIReF forecasts a rise in real GDP that will remain at close to 2% in 2023 and 2024, somewhat lower than the Government’s forecast. In the following years, as the boost from the Recovery, Transformation and Resilience Plan (RTRP) disappears, growth will fall to around 1.7%, in line with the Government’s estimates.

Furthermore, AIReF’s inflation forecasts are higher than the Government’s, particularly in 2023. The acceleration of wage demands envisaged in 2023 to partially recover the purchasing power of 2022 will contribute to slow the short-term fall in inflation. In contrast, in the medium term, the disappearance of supply tensions and the gradual transition of financial conditions to demand will allow prices to be contained.

Fiscal scenario 2023-2026

AIReF estimates that the General Government (GG) deficit will stand at 3% of GDP in 2026, 0.5 points higher than the forecast made in the SPU in 2023, AIReF considers that the deficit will stand at 0.2 points above the reference rate, while in 2024 both AIReF and the SPU expect a reduction of close to 1 point of the deficit, mainly as a result of the withdrawal of the temporary measures. The SPU forecasts a gradual reduction of the deficit between 2024 and 2026, while AIReF forecasts a stabilisation of close to 3% as from 2024.

AIReF forecasts that the weight of revenue over GDP, without including the RTRP, will stand at 43.2% in 2026, 0.6 points below the level forecast in the SPU. In AIReF’s scenario, the evolution of revenue is strongly conditioned by the schedule for the withdrawal of the temporary measures, although it also observes differences by component. Specifically, the SPU presents a higher level of taxes and social contributions, while AIReF estimates higher revenue from other resources. Expenditure, without including the RTRP, reduces its weight in AIReF’s central scenario to 46.2% of GDP in 2026, 0.1 points below the forecast contained in the SPU. This reduction is concentrated in 2023 and 2024 due to the gradual withdrawal of the measures, to then grow on average by close to 4% following its stagnant evolution.

By sub-sector, the profile of the balance is strongly conditioned by the impact of the settlements of the financing system and transfers between sub-sectors. In 2024, the settlement will be high, which drives an improvement in the balance of the Autonomous Regions (ARs) and Local Governments (LGs) and a worsening of the Central Government (CG), despite the withdrawal of the measures. This settlement will be lower in 2025, exercising the opposite effect and will tend to normalise by 2026. Consequently, by 2026, the CG deficit will be partially offset by the AR and LG surplus. Although the profile is different, the SPU also forecasts a surplus of the territorial governments and a lower deficit than forecast by AIReF for the CG. For their part, the Social Security Funds (SSFs), incorporating the new measures, will see their deficit stabilise at close to 0.3% of GDP as from 2024, reaching -0.2% in 2026. The differences of the SSFs in the SPU may be due to different assumptions about the transfers from the CG.

According to AIReF, the direction of fiscal policy over the projection horizon is crucially conditioned by the RTRP. The increase in spending charged to the NGEU funds in 2023 determine the expansive tone that fiscal policy will adopt, which the dynamic nature of nationally-financed investment also contributes to. In contrast, nationally-financed primary current spending net of revenue measures will grow below the potential medium-term rate, in line with the recommendation made by the European Council to Spain and partially offsetting the expansive tone of the previous elements.

Debt

AIReF forecasts a 5.9-point reduction in the debt ratio over the next four years to 107.3% in 2026, mainly due to nominal GDP growth, where the deflector will play a very significant contribution. Accordingly, AIReF considers the Government’s debt forecast included in the SPU for 2026 to be feasible, since both the reduction in the ratio and the composition of the factors that determine its evolution are similar to AIReF’s estimates. However, it forecasts a growing debt ratio in its long-term scenario of inertia, following an initial period of some stabilisation, with the forecast pointing to increased spending associated with the ageing population – one of the main challenges to the sustainability of the public finances in the medium and long term.

In this context, the generation of a fiscal space that allows future disruptions, such as those experienced in recent years, to be addressed, obliges a medium-term plan to be designed that guides the public accounts towards a balanced situation. AIReF’s simulations show that the fiscal path that would comply with the Commission’s guidelines for the period 2024-2027 would require additional measures to be taken, amounting to 0.46 points a year with regard to the scenario forecast by the institution. This adjustment (a cumulative 1.84 points over four years) would lead to a reduction in the debt ratio of 24 points of GDP over the next 15 years, placing this on a clearly downward trend. AIReF’s simulation applied to the Government’s fiscal scenario also points to an adjustment which, in this case, would stand at close to 0.3 points per annum.

Recommendations

In the report, AIReF includes three new recommendations. Firstly, it recommends that work begin on the reform of the national fiscal framework with the participation of the different tiers of the GG from an integral perspective, given that this will not be compatible with the new framework of European governance. It also recommends incorporating an analysis of how to comply with the requirements for debt to remain on a continuous and plausible downward path and of how each tier of government can reach this to guarantee the consistency of the distribution to the resolution of the Council of Ministers that sets the stability targets. According to AIReF, the SPU does not explain whether, after the projection period has stabilised, debt will remain on a downward and plausible path, as specified by the Commission.

Furthermore, taking into account the importance of economic growth for the sustainability of the public finances, AIReF recommends the Ministry of Economic Affairs and Digital Transformation to design a model of governance of the evaluation of the RTRP for the next few years. AIReF also reiterates the recommendations to publish the endorsement of better information that is provided with the request for endorsement, along with the establishment of an agreement or memorandum of understanding (MoU).