- The Independent Authority for Fiscal Responsibility (AIReF) considers that both the GDP growth path and the inflation forecasts are feasible

- It notes that the endorsement has been made on the basis of information available up to 28 April and does not incorporate possible policy measures that may be contained in the Stability Programme Update

- To improve the endorsement process AIReF reiterates its recommendation regarding the need for adequate information on the budgetary and fiscal measures included in the macroeconomic scenario

- AIReF reiterates its recommendation to regulate the endorsement process by means of an agreement or memorandum of understanding

- AIReF will publish the mandatory report on its assessment of the Stability Programme Update in the coming weeks

The Independent Authority for Fiscal Responsibility today published on its website its endorsement of the macroeconomic forecasts accompanying the Stability Programme Update for the years 2023-2026. AIReF considers that both the real and nominal GDP path are feasible and therefore endorses the medium-term macroeconomic scenario put forward by the Government. However, it stresses that the endorsement has been made on the basis of the information available up to 28 April 2023 and therefore it does not include any possible economic policy measures that may be contained in the Stability Programme Update document.

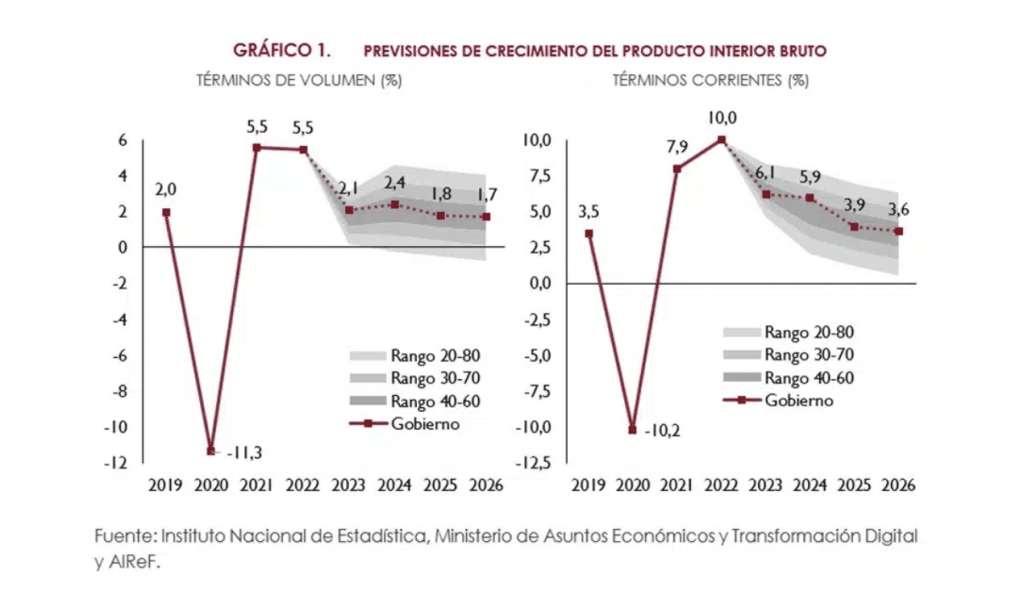

The government’s macroeconomic scenario envisages real GDP growth of 2.1% in 2023, identical to that projected in the General State Budget for 2023 and accelerating to 2.4% in 2024. In 2025 and 2026 real growth flexes downwards as there is a convergence towards potential growth, which the government estimates at 1.6%. Domestic demand is the main support for growth over the projection horizon, underpinned by a favourable performance of employment and investment, with the contribution of net external demand being practically nil on average over the period.

On the price side, the government scenario envisages high growth in the GDP deflator and private consumption in 2023 (4% and 3.9%, respectively), which moderates in the following years and converges to rates close to 2% by the end of the period. In line with this, nominal GDP growth remains high, particularly in 2023 and 2024, with rates of 6.1% and 5.9%, respectively. These rates fall to 3.9% and 3.6% in 2025 and 2026.

The Government’s real GDP growth forecasts are located over the projection period within the central probability range defined around AIReF’s own estimates. At current prices, the estimates for 2023 are below those expected by AIReF as a result of lower expected growth in the GDP deflator, while those for 2024 are at the upper limit of the central range. Overall, the Government’s forecasts are considered feasible and are endorsed as such.

The technical assumptions underlying the medium-term scenario reflect the latest forecasts for global growth and trade by the European Commission and the European Central Bank and expectations about financing conditions and commodity prices on international markets. These external assumptions are marked by declining energy prices, in particular natural gas prices, as well as increases in key interest rate benchmarks. Euro area GDP growth assumptions translate into a significant slowdown in Spain’s export markets in 2023.

AIReF notes that the uncertainty surrounding the government’s medium-term scenario remains high. On the one hand, the rapid and intense tightening of financing conditions could dampen the dynamism of private consumption and investment, especially in the second half of 2023 and in 2024. In this respect, the real growth estimates for 2024 are in the high range of the central probability intervals estimated by AIReF. On the other hand, the Government’s scenario envisages notable employment growth throughout the entire projection horizon, higher than that projected by AIReF and by other institutions and organisations and places the unemployment rate at 9.8% in 2026.

At the global level, the persistence of geopolitical tensions, fragmentation and the monetary and financial cycle pose downside risks to the government’s economic growth and AIReF’s own. The continuation of the war in Ukraine, tensions towards greater trade fragmentation and global investment flows, the tightening of financing conditions and the persistence of high inflation rates all project downside risks to the growth scenario.

On the price side, there are upside risks to the deflators in the government’s scenario, especially in the short term. Base effects on energy and falling energy prices on international markets are allowing headline inflation to decline rapidly (to 4.1% in April, after exceeding rates of 10% between June and August 2022). However, core inflation remains high at over 6% in the same month. Persistently high inflation rates increase the risk of second-round effects on wages and business margins. On the other hand, the drought could put upward pressure on food prices to a greater extent than expected.

Recommendations

AIReF reiterates two live recommendations. On the one hand, it reiterates to the Ministries of Economic Affairs and Digital Transformation and the Ministry of Finance and Civil Service the need to have adequate information on the budgetary and fiscal measures incorporated in the macroeconomic scenario in order to increase the rigour of the endorsement process. AIReF believes that the improvement in the provision of information is particularly relevant in the case of the Recovery, Transformation and Resilience Plan given the central role it can play as a driver of activity.

AIReF also reiterated to the Ministry of Economic Affairs and Digital Transformation the need for the macroeconomic forecast endorsement process to be regulated by means of an agreement or memorandum of understanding between the parties, in line with best practices in neighbouring countries and in order to make the macroeconomic framework endorsement process more transparent and efficient.

AIReF’s endorsement only concerns the macroeconomic scenario that accompanies the Stability Programme Update. In the coming weeks, AIReF will publish the mandatory report on its assessment of the Stability Programme Update and the fiscal scenario it includes, as well as its recommendations in this respect, as it is legally mandated to do.