- The Independent Authority for Fiscal Responsibility considers that the Stability Programme sets out feasible scenarios on both the macroeconomic and fiscal side, but identifies vulnerabilities and asserts that it is still not a true medium-term fiscal strategy

- The structural deficit will stand at around 4% in 2025, 0.6 points above the pre-pandemic level

- The margin to reduce the budget deficit without adopting additional measures is exhausted, with the deficit stabilising at around 3% in 2024 and 2025, which is the limit set by the Stability and Growth Pact

- The stagnation in the reduction of the deficit is a brake on the reduction of the debt ratio, which in 2025 will still stand at 108.8% of GDP As from that moment, if the primary structural deficit remains constant at between 1.5% and 2.5%, the debt will start an upward path that would take it to 140% by 2040

- The macroeconomic scenario, endorsed on April 29th, is similar to that of AIReF. In both cases, the environment is highly uncertain with risks that are higher than usual

- The fiscal path of the Stability Programme Update is also similar to that of AIReF, but with a different time profile, different distribution between sub-sectors and less stringent fiscal reference rates in the early years, which the different public General Government sub-sectors might identify as a margin to carry out more expansive policies

- AIReF insists on the need to design a credible, realistic medium-term fiscal strategy that integrates all the essential elements of economic and fiscal policy, especially the RTRP

- It also recommends applying the higher-than-expected revenue improvement to speed up the reduction of the structural deficit; assessing the impact of the measures adopted before extending them and basing the design of new measures on criteria of efficiency and effectiveness.

The Independent Authority for Fiscal Responsibility (AIReF) today published on its website the Report on the 2022-2025 Stability Programme Update, in which it warns that debt will begin to rise from 2025 if the structural deficit of 4% is not reduced. In its Report, AIReF concludes that the Stability Programme sets out feasible scenarios on both the macroeconomic and fiscal side, although there are numerous vulnerabilities and it is still not the medium-term fiscal strategy that AIReF has recommended on numerous occasions.

On the one hand, in 2025 the structural deficit will stand at around 4%, 0.6 points above the pre-pandemic level. Furthermore, it is noted that at the end of the period the margin to reduce the deficit without adopting additional measures is exhausted, with the deficit stabilising at around 3% in 2024 and 2025, which is the limit set by the Stability and Growth Pact. This stagnation in the reduction of the deficit will put a brake on the reduction of public debt, which in 2025 will still be at very high levels, at 108.8% of GDP. This places Spain in a very vulnerable position in view of the likely tightening of monetary conditions.

On the other hand, the Recovery, Transformation and Resilience Plan (RTRP) is still not integrated into the SPU. Firstly, no realistic path of execution of the investments in national accounting terms or their potential impact on structural spending is presented. Secondly, although the RTRP lists various measures aimed, in principle, at reducing the structural deficit, such as tax or pension reform, among others, the SPU does not integrate them into its budget scenario or quantify their potential impacts.

According to AIReF, the absence of a medium-term fiscal strategy that encompasses all the key elements of fiscal and economic policy is of particular concern in the current macroeconomic scenario with significant downside risks. The situation requires the capacity to adapt economic policy to the possible materialisation of risks arising from, inter alia, the war in Ukraine, inflation and the pandemic. At the same time, a roadmap is required for reducing the structural deficit without hampering economic growth and allowing public debt to be brought to levels that mitigate the vulnerability of the Spanish economy to future crises.

Macroeconomic scenario

AIReF indicates that two years after the outbreak of the COVID-19 pandemic, the Spanish economy has been hit by a succession of global supply shocks that have shifted the focus of uncertainty from the health sector to the supply side of the economy. The development and economic implications of these shocks are difficult to predict. The tensions in global value chains and in raw material markets that had emerged previously have intensified following the invasion of Ukraine, setting up a less favourable scenario for global growth. In addition, after several years at moderate levels, inflation has emerged with unexpected intensity, leading to a tightening of the economy’s financing conditions. For its part, the coronavirus remains a key determining factor for the economic situation.

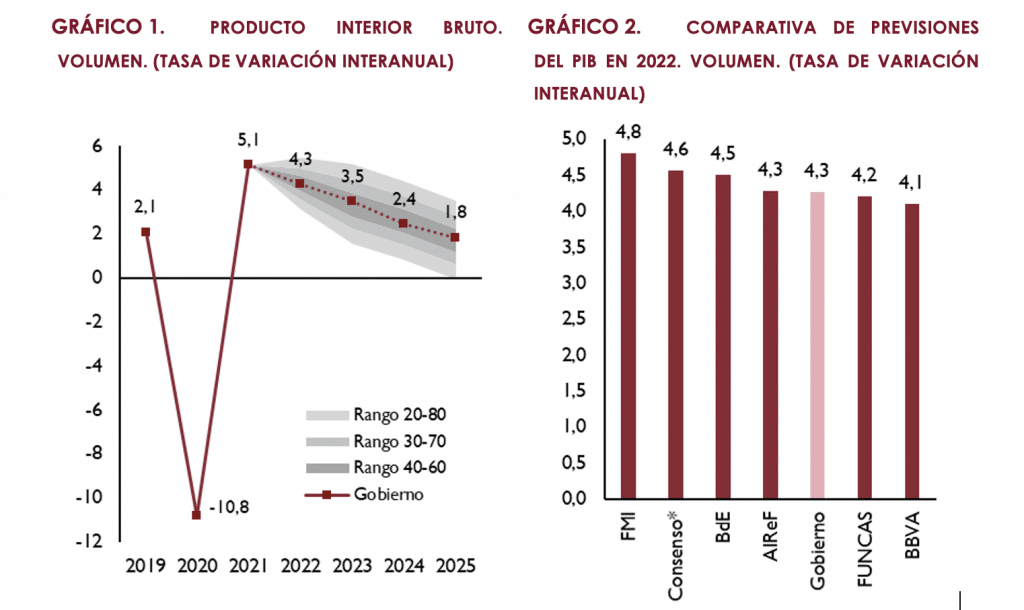

The Stability Programme Update scenario states that in 2022 the growth of the Spanish economy’s GDP will continue along its path of recovery in this highly complex environment, although at a rate of 4.3%, significantly lower than the rate expected by the government last autumn (7%). In the medium term, as the impact of the RTRP fades, the expansion of economic activity will gradually converge with the potential growth of the economy.

AIReF considers that the Stability Programme’s macroeconomic scenario is feasible in an environment of major uncertainty. In fact, the projections of GDP growth at both constant and current prices are in the central probability band calculated by AIReF on the basis of its own scenarios. However, the risks surrounding the Government’s forecasts and those of AIReF itself are higher than usual. The development of the pandemic and the war in Ukraine and, in particular, the threat of disruption in energy supplies may lead to an energy emergency with consequences that are difficult to anticipate. Moreover, China’s pandemic mitigation strategy may also accentuate problems in global value chains. These phenomena would bring greater inflationary pressures, accentuating the risk of a further tightening of the financing conditions and loss of competitiveness of the Spanish economy.

Finally, AIReF points out the lack of specificity in the Stability Programme as regards the macroeconomic impact of the RTRP, an instrument that has taken on even greater importance as a support for economic growth in this highly complex environment.

Fiscal scenario

AIReF estimates that the General Government (GG) deficit will stand at 3% of GDP in 2025, only 0.1 points above the Stability Programme forecast. However, AIReF expects a greater reduction in the deficit in 2022, to 4.2%, in the absence of additional measures. In contrast, the Government maintains the reference rate of 5% despite 2021 closing with a deficit which was 1.5 points lower than its forecast. For the other years, AIReF forecasts a smaller reduction in the deficit than the Stability Programme, to reach 3% of GDP in 2024, a level that is maintained in 2025.

AIReF forecasts that the weight of revenue over GDP, excluding the RTRP, will stand at 41.3% in 2025, in line with the path of the SPU. The weight of expenditure as a proportion of GDP, excluding the RTRP, also falls in AIReF’s central scenario, to 44.3% in 2025, in line with the figure included in the SPU.

By sub-sector, since the Central Government (CG) has assumed most of the increase in the deficit over the crisis, AIReF also expects it to record most of its reduction. The profile of the balance of the ARs and LGs is strongly conditioned by the impact of the settlements of the financing system, which would be negative in 2022 and strongly positive in 2023 and 2024, to then return to normal in 2025. In the case of the ARs, this means ending 2025 with a deficit of 0.1% of GDP. In contrast, the LGs maintain their structural surplus at around 0.3% of GDP. For their part, the Social Security Funds (SSFs), incorporating the new transfers from the CG, would stabilise their deficit at around 0.3% of GDP as from 2024. In general terms, the SPU forecasts a higher deficit for the CG, a lower one for the SSFs and the ARs and a lower surplus for the LGs.

Fiscal policy stance

The fiscal policy stance over the projection horizon is crucially dependent on the RTRP. Excluding the expansionary fiscal boost associated with the RTRP, the evolution of the structural balance suggests that national fiscal policy will take on an expansionary stance until the end of the projection horizon. These estimates show some discrepancies with those contained in the Stability Programme. Specifically, the Government estimates that, after maintaining a slightly expansive stance in 2022, the fiscal policy will maintain a practically neutral stance in 2023 and 2024. However, according to the Government, in 2025 there would then be a structural adjustment that AIReF does not consider to be supported by measures. This improvement in the structural balance might be unrealistic, since the Stability Programme has been drawn up on the basis of a baseline scenario based on the GSB and taking into account the usual optimism presented by the stability programmes in this projection horizon.

In addition, according to AIReF’s estimates, the medium-term structural cost of the pandemic for Spanish public finances is 0.5 percentage points of GDP higher. At the end of the projection period, the structural deficit of the Spanish economy will stand at -4% of GDP, far from the new medium-term target set by the Government of -0.4%.

Sustainability

The significant increase in the stock of public debt places the sustainability of public finances in a highly vulnerable position in the medium term. The debt ratio stood at 118.4% at the end of 2021, an increase of 20.1 points on the pre-pandemic level. For the next four years, AIReF projects a decrease of 9.6 points, which would place it at 108.8% of GDP in 2025. This projection is in line with the 8.7-point reduction presented by the Government in the Stability Programme, which is considered feasible.

The reduction in the ratio will mainly be supported by the growth in nominal GDP, where the deflator will have a very significant contribution. The government deficit will continue to contribute significantly to the increase in debt, with a financial burden that will rise in absolute terms, but will remain stable relative to GDP due to the increase in nominal GDP. The increase in debt interest rates will result in a financial burden €20bn higher than forecast in the previous report on the Stability Programme.

Beyond a certain improvement in the short-term fiscal situation, AIReF’s projections show an unfavourable debt ratio trend under a no-policy-change scenario. The simulations performed by AIReF show that maintaining a constant structural primary deficit of between 1.5 and 2.5% of GDP, in line with the estimates of the Government and AIReF, would initiate an upward trend in the path of the debt ratio, with a growing total deficit as a result of higher interest expenditure.

The high level of debt, together with higher financing rates, will require a sustained structural adjustment to place the debt at more prudent levels, contain the financial burden and generate fiscal space that will make it possible to address future risks. The simulations carried out by AIReF show that achieving balanced public accounts in the next decade will require a sustained structural fiscal adjustment of between 0.25 and 0.5 points per year. Accordingly, an annual adjustment of 0.35 points would make it possible to reduce the debt ratio to 80% in 2040, achieving budgetary balance in 2035 and maintaining a low interest expenditure of around 2.5% of GDP.

The new crisis scenario that has emerged following the invasion of Ukraine may alter the process of normalisation of monetary conditions that was expected over 2022 as a result of the sharp increase in inflation worldwide. The war in Ukraine generates new investment needs in the short and medium term associated with both defence spending and the greater urgency to increase renewable energy production capacity and reduce dependence on Russian energy. The above is compounded by the challenge of an ageing population and higher pension expenditure, which, if not financed with additional revenue, will lead to a very significant increase in debt from levels that are already historically very high.

Recommendations

In this context, and in view of the shortcomings identified in the SPU, AIReF once again insists on the need for a credible and realistic medium-term fiscal strategy that guarantees the sustainability of public finances.

In addition, it includes a new recommendation in response to the government’s 5% deficit reference rate for 2022, which is not demanding, and an increase in revenue above that forecast in the budget. These circumstances may generate the risk that they will be viewed by the different administrations as a margin to conduct a more expansive fiscal policy than that resulting from the budgets already approved. In addition, higher-than-expected inflation would also bring an additional increase in revenue in the short term, which could reinforce that idea.

For their part, the ARs and the LGs will enjoy a sharp increase in revenue on a purely temporary basis in 2022 and 2023 through the settlements of the financing systems. There is a risk that this temporary revenue will also be allocated to finance increases in expenditure or reductions in other revenue on a structural basis.

According to AIReF, these risks are more evident in the absence of a medium-term fiscal strategy and in a context of suspended fiscal rules and uncertainty about the future fiscal framework. Therefore, the institution introduces a new recommendation on the need to allocate any above-forecast revenue and temporary revenue to speeding up the necessary reduction in the structural deficit and to avoid structural increases in expenditure or reductions in revenue that do not also have structural financing.

In addition, AIReF notes that persistent or aggravated tensions in energy markets may lead to the need to approve an extension of existing measures or even additional measures. Taking into account the vulnerable position of the Spanish economy, AIReF includes two new recommendations. The first is on the need to assess the impact of the measures already adopted in terms of efficiency, effectiveness and redistributive impact before deciding, where necessary, on their possible extension. The second recommendation is on the importance of designing new measures taking into account the criteria of effectiveness, efficiency and redistributive impact and setting out in an explicit and quantified manner the objectives pursued, the time frame and the circumstances and assumptions under which they would be extended, as well as the procedure for their evaluation. Along the same lines, in the event that they involve a structural increase in the deficit, to identify their source of financing.